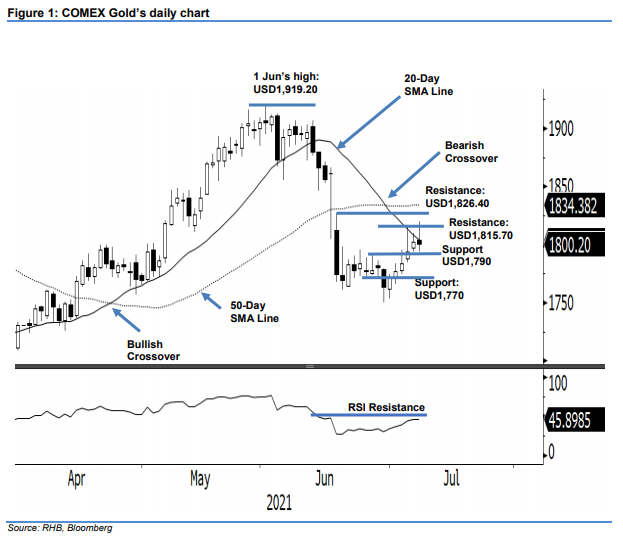

COMEX Gold - Blocked by the 20-Day SMA Line

rhboskres

Publish date: Fri, 09 Jul 2021, 05:27 PM

Maintain long positions. The COMEX Gold’s bulls took a breather yesterday, declining USD1.90 to settle at USD1,800.20. It initially started Thursday’s session at USD1,803.80. Moving into the US session, it jumped to test the intraday high at USD1,819.50. Selling pressure emerged again near the 20-day SMA line, where the commodity retreated to the USD1,793.50 day low and closed at USD1,800.20. If the COMEX Gold manages to consolidate above the USD1,790 support level, we may see the bullish momentum resume again and retest the 20-day SMA line. Crossing above the moving average will see the bulls rally higher. At present, we maintain our positive trading bias.

Traders should stay with long positions, which we initiated at USD1,794.20, ie the closing level of 6 Jul. To mitigate downside risks, the stop-loss level is fixed at USD1,760.

The immediate support is placed at USD1,790, followed by the USD1,770 whole number. Meanwhile, the nearest resistance is set at USD1,815.70 – the high of 6 Jul – with the higher one at USD1,826.40, ie 17 Jun’s high.

Source: RHB Securities Research - 9 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024