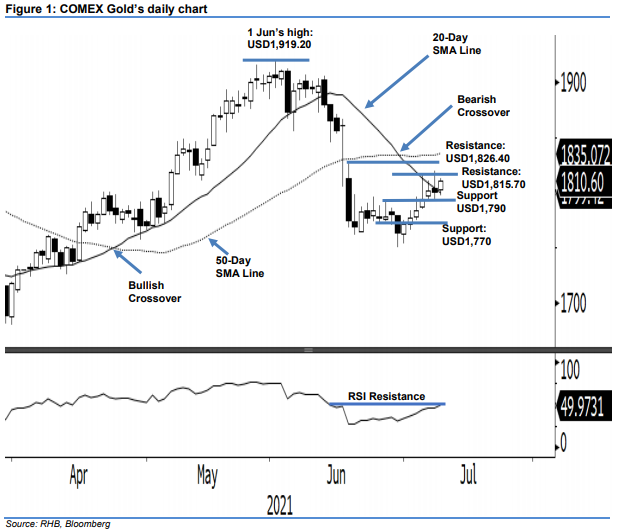

COMEX Gold - Bulls Reclaim the 20-Day SMA Line

rhboskres

Publish date: Mon, 12 Jul 2021, 09:40 AM

Maintain long positions. After the bulls took a breather last Thursday, the COMEX Gold regained momentum by breaching above the 21-day SMA line on Friday – rising USD10.40 to settle at USD1,808.60. On Friday, it opened at USD1,803.20 and fell to test the intraday low of USD1,796.60. During the US session, buying pressure reemerged near the 20-day SMA line to lift the commodity to the day’s high of USD1,813.00, before it closed at USD1,810.60. As the COMEX Gold managed to consolidate above the USD1,790 support level, bullish momentum has resumed above the 20-day SMA line, and is expected to move higher. We stick to our positive trading bias.

Traders should maintain long positions, which were initiated at USD1,794.20, or the closing level of 6 Jul. To mitigate downside risks, the stop-loss level is revised higher to USD1,784.70 from USD1,760.

The nearest support is placed at USD1,790, and then the USD1,770 round figure. Meanwhile, the nearest resistance is fixed at USD1,815.70 (6 Jul’s high), followed by USD1,826.40, or 17 Jun’s high.

Source: RHB Securities Research - 12 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024