WTI Crude - Testing the USD75.00 Resistance Level

rhboskres

Publish date: Mon, 12 Jul 2021, 09:41 AM

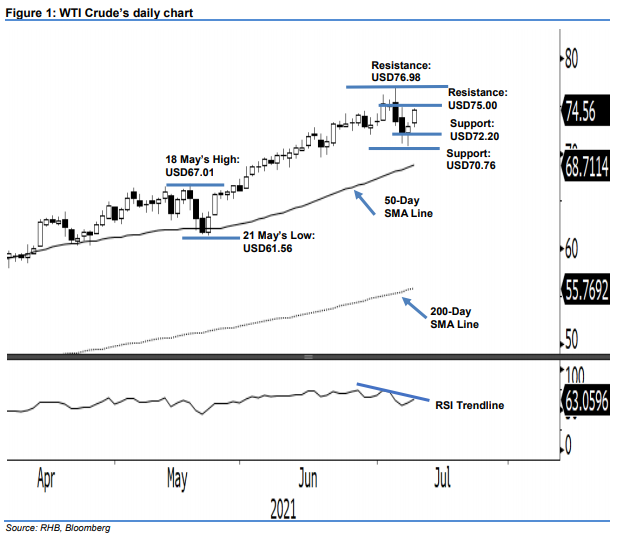

Maintain short positions. The WTI Crude continued its mild rebound with a strong positive momentum last Friday, jumping USD1.62 to settle at USD74.56. Following last Thursday’s rebound, it opened Friday’s session at USD73.26, before falling to the session’s low of USD72.72. It then regained the intraday losses and climbed to the session’s high of USD74.76 before settling at USD74.56. Although the black gold moved higher above the immediate resistance, it has yet to cross above the USD75.00 resistance level to form a “higher high” pattern. Nevertheless, Friday’s strong positive movement shows that the uptrend reversal above MYR75.00 is imminent. Until it crosses above the next resistance, forming a “higher high” pattern, we will keep our negative trading bias.

We recommend traders retain the short positions initiated at USD72.20, or the closing level of 7 Jul. To manage trading risks, an initial stop-loss is set at USD75.35.

The two nearest support levels are moved to USD72.20, 7 Jul’s close, and USD70.76, or the low of 8 Jul. Conversely, the immediate resistance is revised to USD75.00, followed by USD76.98 (the high of 6 Jul).

Source: RHB Securities Research - 12 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024