FKLI - Selling Pressure Persists

rhboskres

Publish date: Tue, 13 Jul 2021, 09:57 AM

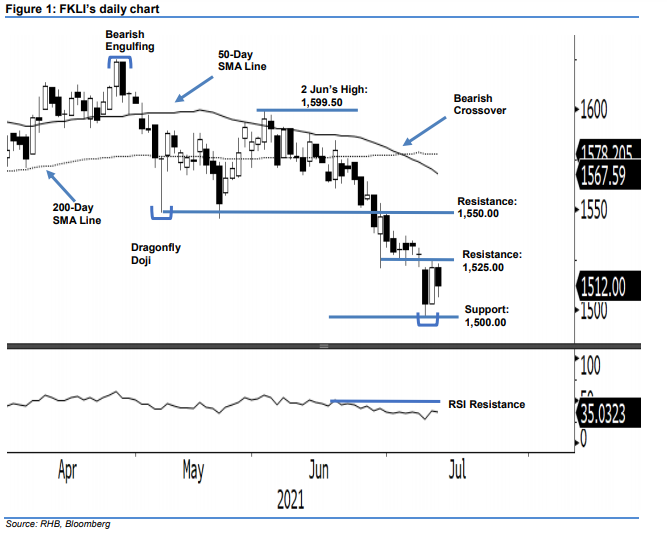

Maintain short positions. Yesterday, the FKLI retraced mildly by 9.5 pts lower to close at 1,512.0 pts. The index opened at 1,521.5 pts, then tapped the day’s high of 1,523.0 pts before moving into south towards the intraday low of 1,506.0 pts. Since it failed to stay above 1,520 pts (the previous support level), we regard the bullish momentum that emerged last Friday as a weak one that has not followed through. With the index trending downwards again, we expect it to test the 1,500-pt support level, before embarking on a major downward movement. As such, we maintain a bearish view in our trading bias.

We suggest that traders remain in short positions. We initiated these at 1,569.50 pts, or 11 Jun’s closing. To control trading risks, the trailing-stop is placed at 1,550.00 pts.

The immediate support level has been revised to 1,500 pts, followed by 1,449 pts, the lowest level in Nov 2020. Conversely, the immediate resistance levels have been adjusted to 1,525.00 pts (9 Jul’s high), then 1,550.00 pts, or 26 Feb’s low.

Source: RHB Securities Research - 13 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024