COMEX Gold - Eyeing to Test the Upside Resistance

rhboskres

Publish date: Tue, 13 Jul 2021, 09:58 AM

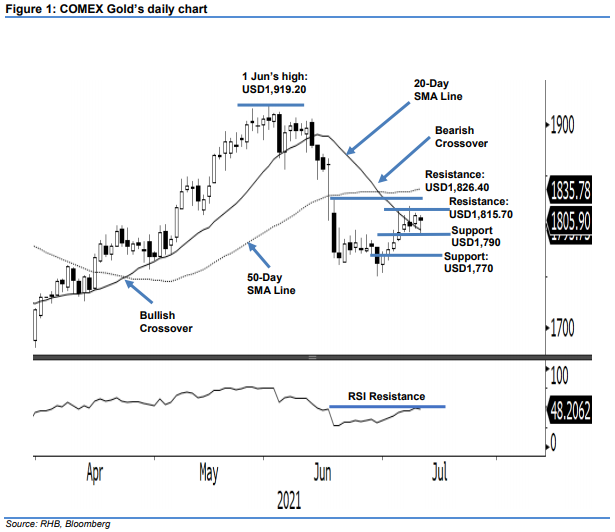

Maintain long positions. Despite mild proft-taking yesterday, which saw the COMEX Gold dip USD4.70, the commodity managed to hold on to the USD1,790 support level and settled at USD1,805.90. The yellow metal started Monday’s session at USD1,808.50. After it touched the USD1,811 session high, it fell to the USD1,791 session low. During the US trading session, strong buying interest emerged near the session low, where the COMEX Gold bounced back to pare the intraday losses and close at USD1,805.90 – printing a long lower shadow on the chart. The bullish pattern indicates that the bulls remain in the market and are bottom fishing near the 20- day SMA line. It is likely that the commodity will consolidate along the 20-day SMA line during the coming sessions. Once the moving average curves up, the bullish momentum will accelerate and lift prices higher – testing the resistance levels. Pending this happening, we hold on to our positive trading bias.

We recommend traders to keep the long positions initiated at USD1,794.20, or the closing level of 6 Jul. To manage risks, the stop-loss threshold is fixed at USD1,784.70.

On the downside, the nearest support is marked at USD1,790 and then the USD1,770 round figure. Conversely, the nearest resistance is eyed at USD1,815.70 – 6 Jul’s high – and followed by USD1,826.40, or 17 Jun’s high.

Source: RHB Securities Research - 13 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024