E-Mini Dow - The Bulls Are Still in Control

rhboskres

Publish date: Tue, 13 Jul 2021, 09:58 AM

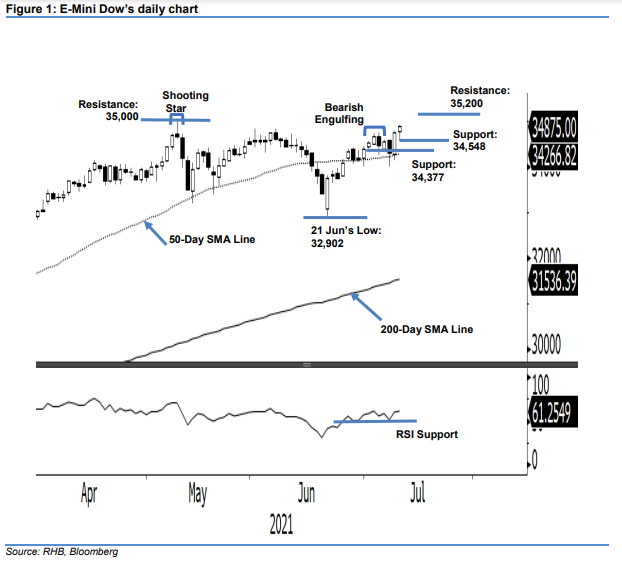

Maintain long positions. After last Friday’s strong momentum, the E-Mini Dow marched higher during Monday’s session, rising 124 pts to settle at 34,875 pts. The index initially started the latter session at 34,765 pts. The bears were eager to take profit during the early session, which saw the index fall to the 34,548-pt day low. The tide changed during the US trading session, where the E-Mini Dow reversed and clinched the 34,904-pt day high before settling stronger at 34,875 pts. The latest positive price action has negated the Bearish Engulfing pattern formed on 6 Jul, and the bulls are eyeing to test the all-time-high resistance at 35,000 pts. If the index manages to take out the resistance level, it will move higher into uncharted territory – a higher resistance level is estimated at 35,200 pts. With the bullish momentum accelerating, we hold on to our positive trading bias.

We advise traders to stick with the long positions initiated at 34,082 pts, or the closing level of 24 Jun. To trail the 50-day SMA line and manage the downside risks, a trailing-stop mark is placed at 34,150 pts.

The immediate support is marked at 34,548 pts, the low of 12 Jul, and followed by 34,377 pts – the low of 1 Jul. On the upside, the resistance levels are eyed at 35,000 pts – 2021’s high – and 35,200 pts, ie the potential new high.

Source: RHB Securities Research - 13 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024