Hang Seng Index Futures - Technical Rebound Extended

rhboskres

Publish date: Tue, 13 Jul 2021, 09:59 AM

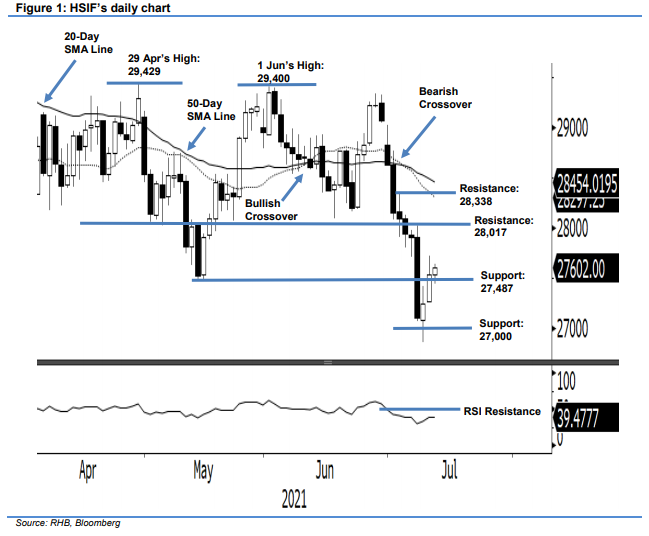

Maintain short positions. The HSIF’s sentiment, buoyed by the People's Bank of China’s latest policy move, saw the index climbing 284 pts to settle Monday’s day session at 27,531 pts – reclaiming the 27,487-pt support level. It opened stronger at 27,606 pts yesterday and, after touching the 27,666-pt day high, retraced to the 27,352-pt day low. It finally closed at 27,531 pts. During evening session, the HSIF tracked its regional peers to extend 71 pts from the day session and last traded at 27,602 pts. With the renewed bullish momentum, the index is set to see follow-through action and test the 28,017-pt resistance level. For the last six months, this level has been tested on several occasions – it is now a strong support-turned-resistance mark. Hence, selling pressure is likely to emerge at this level to test the bulls. Before the HSIF can cross this resistance threshold, we stick to our negative trading bias.

Traders are advised to retain the short positions initiated at 28,630 pts, or the closing level of 30 Jun’s day session. For risk management, the trailing-stop level is placed at the 28,000-pt round figure.

The immediate support is marked at 27,487 pts, or 13 May’s low, and then the 27,000-pt psychological level. The resistance levels are pegged at 28,017 pts – 8 Jul’s high – and 28,338 pts, ie 5 Jul’s high.

Source: RHB Securities Research - 13 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024