WTI Crude - Consolidates Beneath the USD75.00 Resistance Level

rhboskres

Publish date: Tue, 13 Jul 2021, 09:59 AM

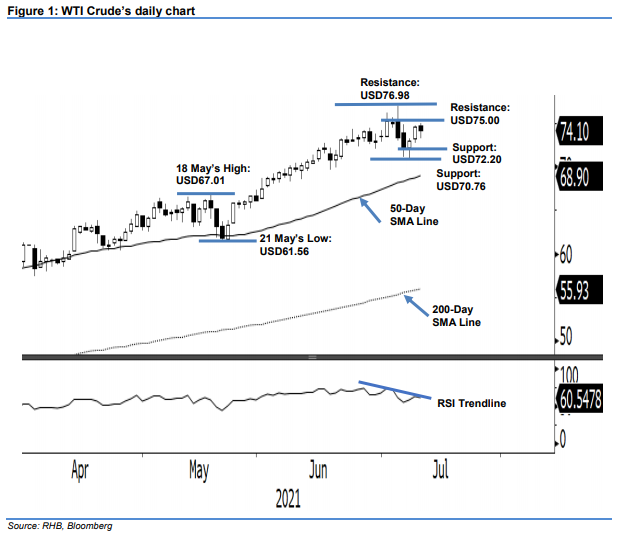

Maintain short positions. The WTI Crude saw mild correction yesterday, dipping USD0.46 to settle at USD74.10. The commodity started Monday at USD74.74 and fell to the USD73.16 session low. Mild buying interest existed during the European session, where it recouped the intraday losses partially and closed at USD74.10. Based on the recent price action, both bulls and bears are at equal strength. The WTI Crude is consolidating sideways between the range of USD75.00 and USD72.20. While it consolidates, expect the volatility – the difference between the day high and low – to be low. If the commodity breaks out from either of the boundaries, volatility will pick up and a new trend will be formed. Meanwhile, we maintain our negative trading bias until the stop loss is breached.

Traders should maintain the short positions initiated at USD72.20, or the closing level of 7 Jul. To mitigate trading risks, an initial stop-loss level is fixed at USD75.35.

The immediate support level remains at USD72.20 – 7 Jul’s close – and followed by USD70.76, or the low of 8 Jul. Meanwhile, the immediate resistance is pegged at USD75.00 and followed by USD76.98, ie the high of 6 Jul.

Source: RHB Securities Research - 13 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024