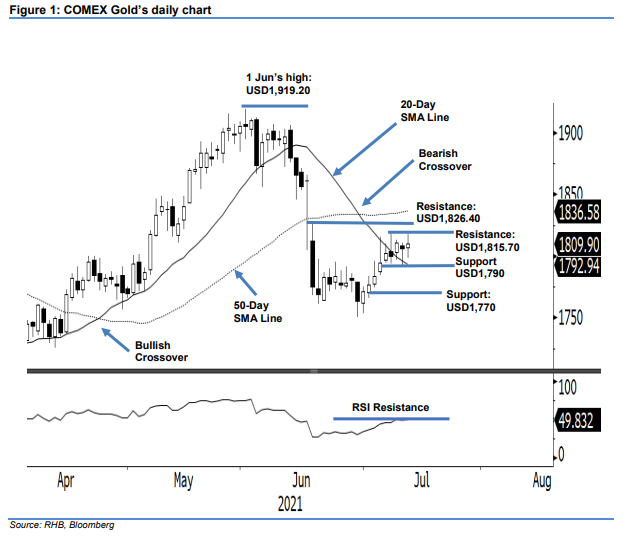

COMEX Gold - Consolidating Above the 20-Day SMA Line

rhboskres

Publish date: Wed, 14 Jul 2021, 05:49 PM

Maintain long positions. The COMEX Gold saw a choppy session yesterday but, despite dipping USD4.70, the commodity managed to move USD4.00 higher to settle at USD1,809.90. It began Tuesday’s session at USD1,806.70, but, moments before the US session started, the COMEX Gold fell rapidly to the USD1,798.70 day low. The selling pressure was again neutralised by strong buying activites, which saw the commodity rebounding to the record day high of USD1,818 – it closed at USD1,809.90. Based on the last three sessions, we clearly see the candlesticks printing long lower shadows, indicating that the bulls are forming a strong interim base near the 20-day SMA line. As long as the COMEX Gold continues to trade above the moving average, the recent upward movement will be further strengthened once the RSI crosses above the 50% threshold. Premised on this, we are keeping with our positive trading bias.

Traders are recommended to maintain the long positions initiated at USD1,794.20, or the closing level of 6 Jul. To mitigate the risks, the stop-loss threshold is set at USD1,784.70.

The nearest support is marked at USD1,790 and then the USD1,770 round figure. Meanwhile, the nearest resistance is set at USD1,815.70 – 6 Jul’s high – and followed by USD1,826.40, or 17 Jun’s high.

Source: RHB Securities Research - 14 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024