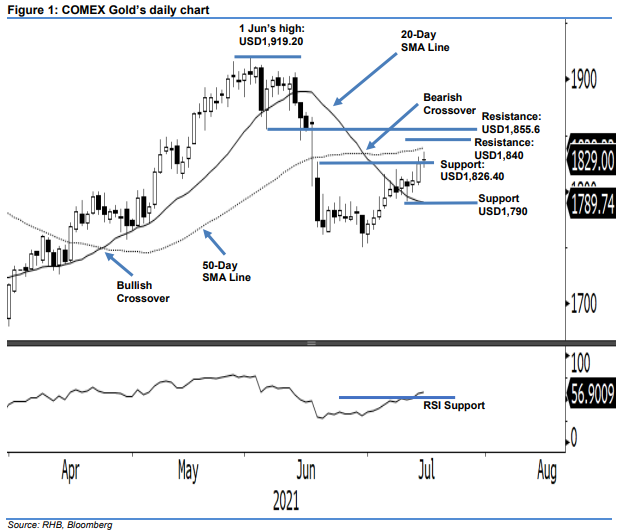

COMEX Gold - Bulls Eyeing to Test the 50-Day SMA Line

rhboskres

Publish date: Fri, 16 Jul 2021, 05:24 PM

Maintain long positions. After soaring high on Wednesday, the COMEX Gold climbed further, albeit marginally by USD4.00, to settle Thursday’s session at USD1,829. It started the session with a jump at USD1,828.70 and then whipsawed between the high and low of USD1,835 and USD1,820.60. The commodity closed near to the opening at USD1,829. The doji candlestick that formed yesterday after the recent uptrend shows the bulls are taking a breather before moving further above the 50-day SMA line of USD1,837.50. Premised with the RSI curving upwards towards the 60% level, the likelihood is high for the COMEX Gold to continue its bullish momentum to breach above the 50-day SMA line. Unless strong profit-taking takes place – breaching below the 20-day SMA line – we retain our positive trading bias.

We suggest traders maintain the long positions initiated at USD1,794.20, or the closing level of 6 Jul. To mitigate the downside risks, the stop-loss threshold is revised higher at USD1,790.

The nearest support levels are revised to USD1,826.40 – 17 Jun’s high – and the USD1,790 round figure. Meanwhile, the upside resistance is set at the USD1,840 whole number and followed by the USD1,855.60, or 4 Jun’s low.

Source: RHB Securities Research - 16 Jul 2021