FKLI - Attempting to Cross the Immediate Resistance

rhboskres

Publish date: Wed, 21 Jul 2021, 05:11 PM

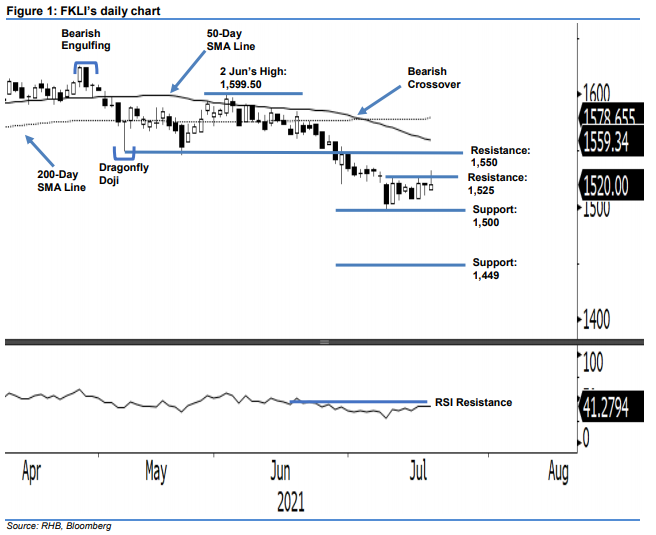

Maintain short positions. On Monday, despite the strong momentum that hit the FKLI’s intraday high above the immediate resistance level, it fell sharply at the 11th hour to close 0.5 pts lower at 1,520 pts – failing to cross the 1,525- pt resistance level. The index opened weaker on the day with a gap down at 1,515.50 pts. It then touched its intraday low of 1,514.50 pts before reversing direction northwards to hit the day’s high of 1,532.50 pts during mid session. In the afternoon session, the bears dragged it towards the day low of 1,518.50 pts just before closing at 1,519 pts. The “long upper shadow” candle signals that the resistance level at 1,525 pts remains intact with persisting selling pressure. If the negative momentum follows through, the FKLI may retest the 1,500-pt immediate support level. Nevertheless, if the index crosses above 1,525 pts with a convincing close, the bulls may take the lead for a strong rebound. Under the current scenario, we stick to our negative trading bias.

We suggest traders remain in short positions. We initiated these at 1,569.50 pts, or 11 Jun’s close. To mitigate trading risks, we placed the trailing-stop threshold at 1,525 pts, ie the immediate resistance.

The immediate support level is pegged at 1,500 pts, and then 1,449 pts, or Nov 2020’s lowest level. Meanwhile, the closest resistance level is at 1,525 pts – 9 Jul’s high – and, subsequently, at 1,550 pts, ie the low of 26 Feb.

Source: RHB Securities Research - 21 Jul 2021