Hang Seng Index Futures - Shifting Back to a Negative Momentum

rhboskres

Publish date: Wed, 21 Jul 2021, 05:13 PM

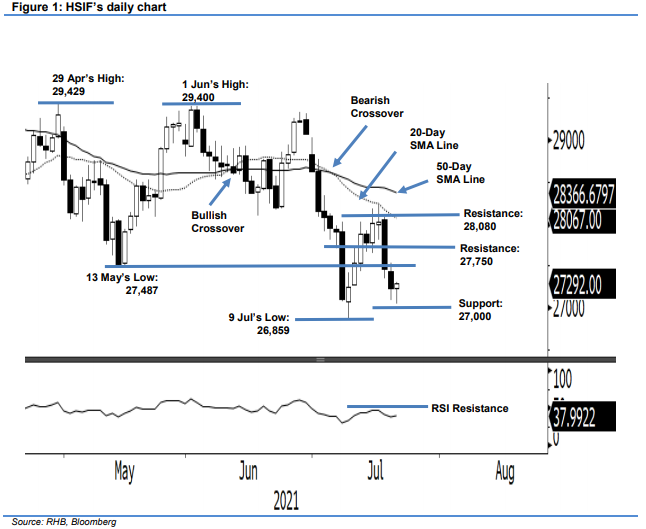

Stop-loss level triggered; initiate short positions. During both Monday and Tuesday’s sessions, the HSIF saw selling pressure accelerating, wiping off the gains made during the previous week and breaching the 27,487-pt support level. At the time of writing, the index last traded at 27,292 pts. From the recent price action, the index made a false break at the 28,000-pt psychological level, and the previous rebound was capped by the 20-day SMA line. With the latest price action weakness, sentiment became risk off again. With both the 20- and 50-day SMA lines trending lower, these will add selling pressure on the index. Unless the HSIF reclaims the 28,000-pt level again, we expect more corrections ahead. Since the stop-loss level is breached, we shift to a negative trading bias.

We closed out the long positions initiated at 28,012 pts – the closing level of 15 Jul – after the stop-loss mark at 27,487 pts was triggered during 19 Jul’s day session. Conversely, we initiate short positions at the closing level of 19 Jul, ie 27,469 pts. To manage trading risks, the initial stop-loss threshold is set at 28,080 pts.

The immediate support is marked at 27,000 pts and followed by the 26,600-pt whole number. On the upside, the immediate resistance level is seen at the 27,750-pt round figure, followed by 28,080 pts, ie 19 Jul’s high.

Source: RHB Securities Research - 21 Jul 2021

.png)