E-Mini Dow - The Positive Momentum Persists

rhboskres

Publish date: Fri, 13 Aug 2021, 05:46 PM

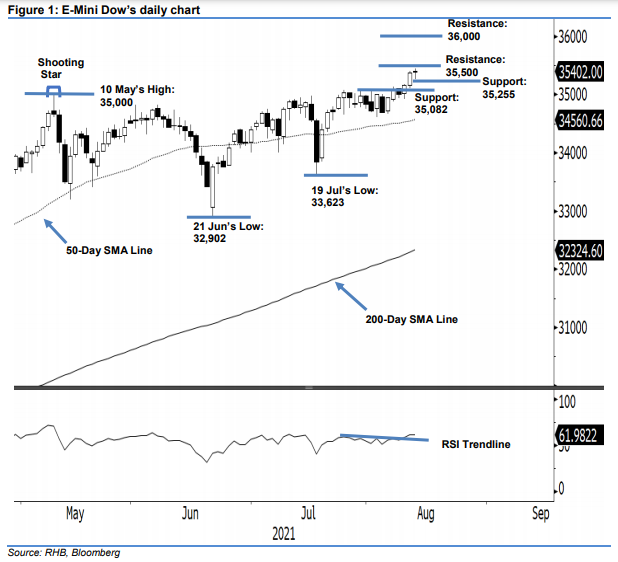

Maintain long positions. The E-Mini Dow bounced off its intraday low yesterday to close 30 pts higher at 35,402 pts. After opening with a neutral tone at 35,381 pts, it moved sideways until the early session, which then whipsawed and hit the intra-day low of 35,255 pts. During the mid-US trading session, the index bounced off its bottom strongly towards the 35,438-pt day high just before its close. The recent bullish candlestick with long lower shadow indicates that strong buying momentum appeared at the E-Mini Dow’s intra-day low to deny the selling pressure from persisting – firming the recent bullish momentum supported by the positive strength of the RSI above the 60% level. However, we do not discount the possibility of mild profit-taking in the immediate term above yesterday’s intra-day low of 35,255 pts. Until the stop-loss mark is breached, we stick to our positive trading bias.

Traders should remain in the long positions initiated at 35,091 pts, or the closing level of 6 Aug. To manage the trading risks, the stop-loss level is pegged at 35,082 pts – 2 Aug’s high – or the immediate support.

The immediate support level is revised higher to 35,255 pts – 12 Aug’s low – followed by 35,082 pts, or 2 Aug’s high. The resistance levels are retained at 35,500 pts and the 36,000-pt round number.

Source: RHB Securities Research - 13 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024