Hang Seng Index Futures- Capped by the 20-Day SMA Line

rhboskres

Publish date: Thu, 26 Aug 2021, 11:38 AM

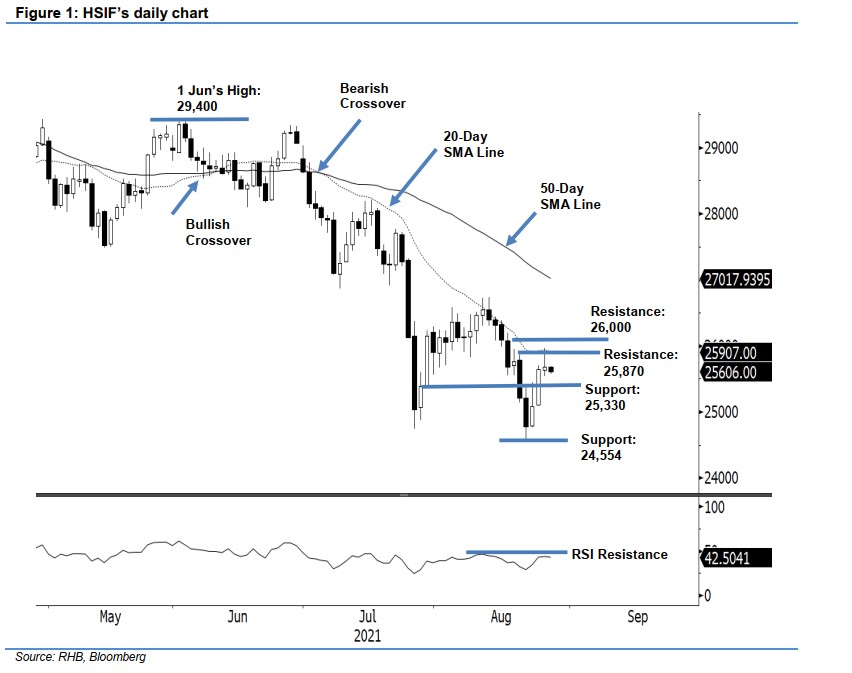

Maintain long positions. The HSIF’s upside movement was capped by the 20-day SMA line yesterday despite adding 42 pts to settle the day session at 25,680 pts. The index began at 25,768 pts. It rose higher towards the 25,955-pt day high before giving up the intraday gains to reach the 25,533-pt day low – it closed at 25,680 pts. During the evening session, the HSIF retreated 74 pts and last traded at 25,606 pts. Looking back, since forming the interim low at 24,544 pts, the index has been moving up on a technical rebound for three consecutive sessions. Although in a medium-term timeframe – with the major trend, or 50-day SMA line, pointing downwards – the HSIF will extend the current counter-trend rebound as long as it continues to stay above its immediate support. As such, we stick to a positive trading bias until the stop-loss threshold is triggered.

We recommend traders shift to the long position initiated at the closing level of 24 Aug’s day session, ie 25,638 pts. To manage the downside risks, the stop-loss mark is revised to 25,200 pts. The immediate support remains at 25,330 pts – 29 Jul’s low – and followed by 24,554 pts, ie 20 Aug’s low.

The immediate resistance is seen at 25,870 pts – 19 Aug’s high – and followed by the 26,000-pt psychological level.

Source: RHB Securities Research - 26 Aug 2021