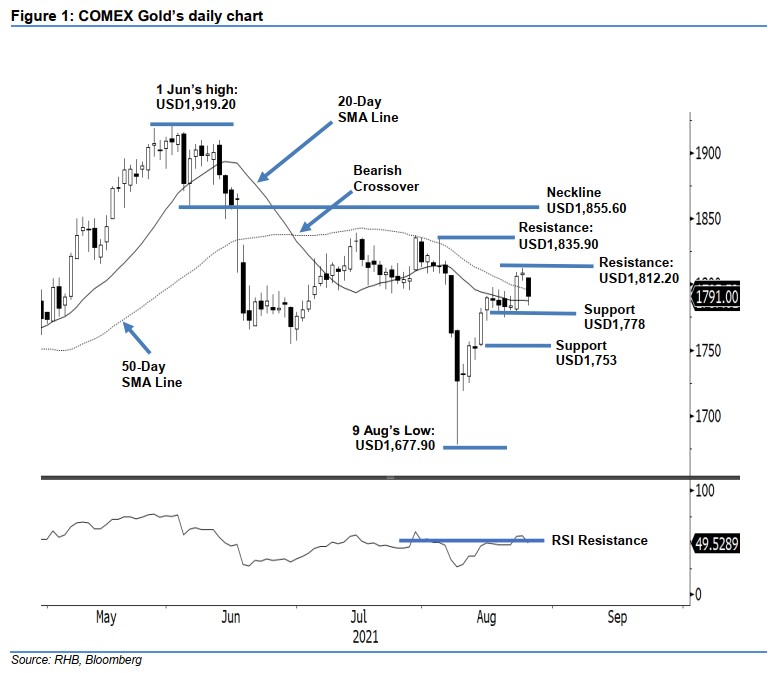

COMEX Gold- Drifting Lower to Test the 20-Day SMA Line

rhboskres

Publish date: Thu, 26 Aug 2021, 11:40 AM

Maintain long positions. Pending US Federal Reserve Chairman Jerome Powell’s upcoming speech at the Jackson Hole meeting on Friday, the COMEX Gold retraced on profit-taking. It dipped USD17.50 yesterday to settle at USD1,791. The commodity initially started Wednesday’s session at USD1,805.10. Strong selling pressure dragged it lower to touch the USD1,784 day low before it rebounded from the 20-day SMA line to close at USD1,791. As mentioned in our previous note, the 20-day SMA line will act as strong support. Breaching the moving average may see sentiment dented with a “lower low” bearish pattern. We think the COMEX Gold will consolidate sideways along the moving average, pending a meaningful breakout. At this juncture, we stick to our positive trading bias.

We recommend traders to hold on to the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For trading-risk management, the stop-loss level is fixed at USD1,772.

The nearest support remains at USD1,778 – 23 Aug’s low – and is followed by USD1,753, which was 13 Aug’s low. The immediate resistance is pegged at the USD1,812.20 – 24 Aug’s high – mark and then the higher hurdle of USD1,835.90, ie the high of 4 Aug.

Source: RHB Securities Research - 26 Aug 2021