Hang Seng Index Futures- Drifting Lower to Test the Immediate Support

rhboskres

Publish date: Fri, 27 Aug 2021, 05:37 PM

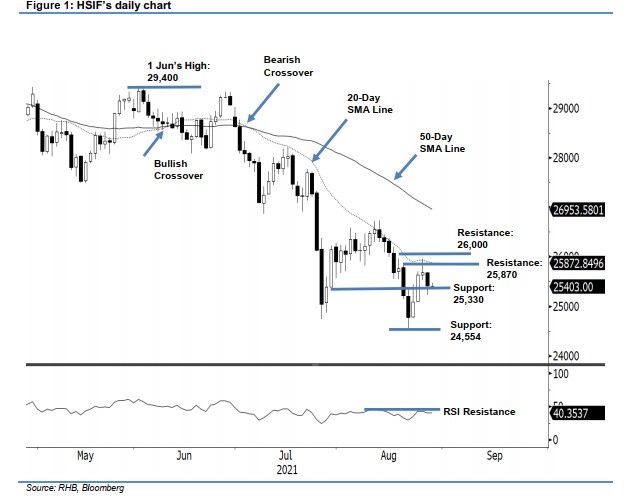

Retain long positions. After being rejected from the 20-day SMA line on Wednesday, the HSIF extended the corrective movement yesterday, retracing 263 pts to settle the day session at 25,417 pts. It initially started Thursday at 25,550 pts. After swinging up to test the 25,682-pt day high, the buying momentum waned, which saw the index retreating to touch the 25,229-pt day low before a mild rebound to close at 25,417 ps. It moved relatively unchanged in the evening session and last traded at 25,403 pts. The latest session showed mild buying interest emerging near the immediate support level and, if the HSIF sustains above this threshold, we might see a rebound in the coming sessions. Otherwise, breaking below this immediate support will see a fresh “lower low” bearish pattern, which may attract further selling pressure. At this juncture, we keep to a positive trading bias until the stop loss is triggered.

Traders should retain the long positions initiated at the closing level of 24 Aug’s day session, ie 25,638 pts. For trading-risk management, the stop-loss mark is fixed at 25,200 pts.

The immediate support fixed at 25,330 pts – 29 Jul’s low – and followed by 24,554 pts, ie 20 Aug’s low. Meanwhile, the immediate resistance kept at 25,870 pts – 19 Aug’s high – and followed by the 26,000-pt psychological level

Source: RHB Securities Research - 27 Aug 2021