FCPO: Eyeing To Cross The Immediate Resistance

rhboskres

Publish date: Tue, 14 Sep 2021, 06:34 PM

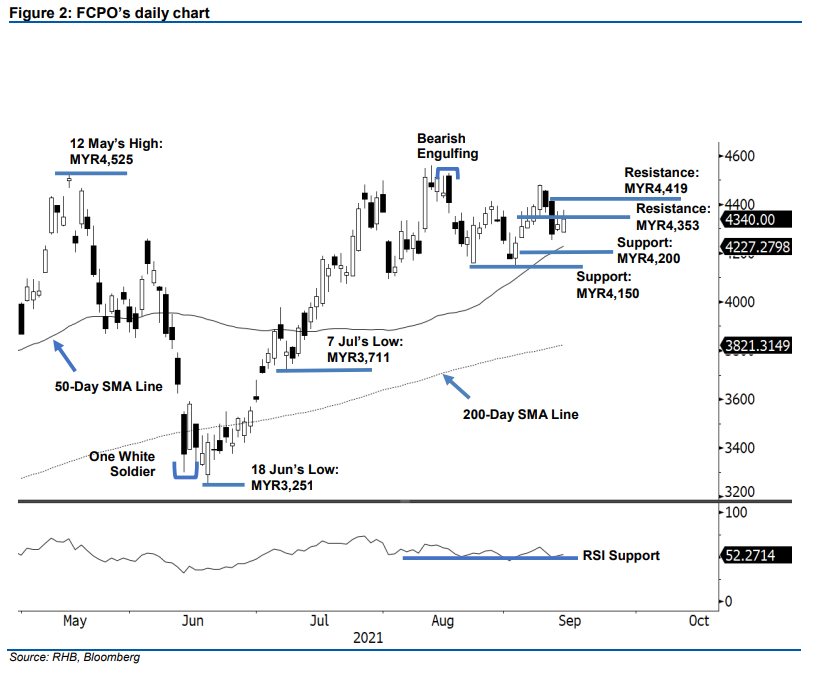

Maintain short positions. The FCPO saw the bullish momentum continue for the second consecutive session, rising MYR22 to settle at MYR4,340. Initially, the commodity began Tuesday’s session weaker at MYR4,288. After establishing the day’s low at MYR4,285, it reversed upwards to test the MYR4,378 intraday high. However, selling pressure emerged near the MYR4,353 resistance, sending the commodity lower to close at MYR4,340. Despite mild profit taking activities occurring during the afternoon session, the commodity managed to close higher than its opening price – the bullish momentum is gaining traction now. As the RSI indicator is rounding up, we do not discount the possibility of the positive price action following through in the upcoming session. Meanwhile, expect rollover activities to happen on 15 Sep – hence selling pressure to be heightened near the MYR4,353 and MYR4,419 resistance level. We stick to our negative trading bias until the stop-loss is breached.

We recommend traders retain their short positions initiated at MYR4.278, or the closing level of 10 Sep. To manage trading risks, the initial stop-loss is set at MYR4,419, or the high of 10 Sep.

The first support is marked at the MYR4,200 round figure, followed by MYR4,150, the low of 2 Sep. The nearest resistance is seen at MYR4,353 – the low of 8 Sep – followed by MYR4,419, or the high of 10 Sep

Source: RHB Securities Research - 14 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024