FKLI: Attempting To Form Interim Base

rhboskres

Publish date: Fri, 17 Sep 2021, 04:06 PM

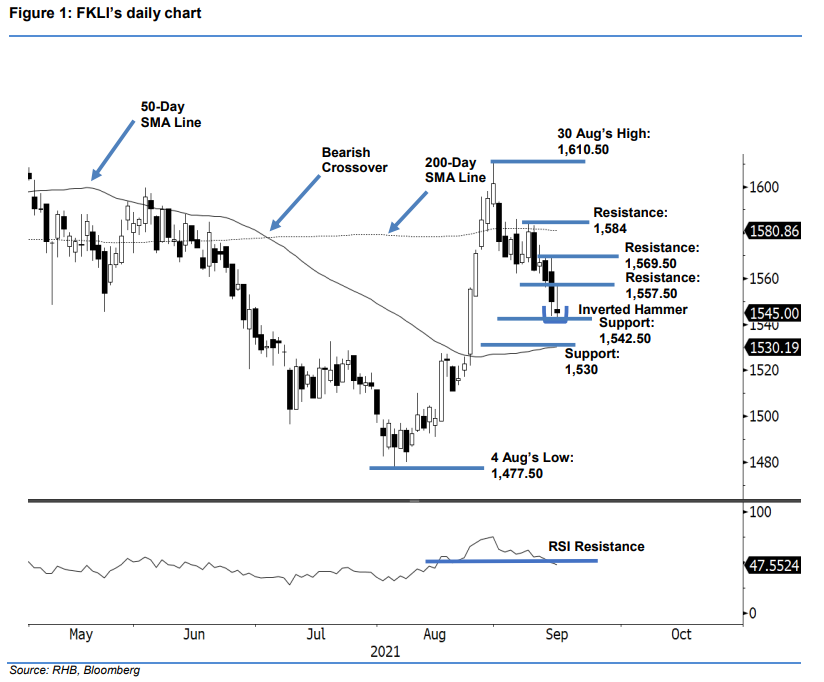

Maintain short positions. After breaching its previous support of 1,550 pts, the FKLI attempted to build an interim base on Wednesday, falling 5 pts to close at 1,545 pts. It opened at 1,546.50 pts. Not long after the opening, it rose to test the intraday high of 1,557.50 pts. The index then pared intraday gains to reach the day’s low of 1,542.50 pts, before closing at 1,545 pts – printing an Inverted Hammer pattern. If it can break past the immediate resistance of 1,557.50 pts in the coming sessions, market sentiment may turn positive again. Otherwise, breaching the 1,542.50-pt immediate support would see the index drifting lower to seek another stronger support, which can be found at 1,530 pts or the 50-day SMA line. For now, we hold on our negative trading bias.

Traders should keep to the short positions initiated at 1,569.50 pts, or the close of 2 Sep. To manage trading risks, the trailing-stop threshold is set at 1,562 pts.

The immediate support is revised to 1,542.5 pts or the low of 15 Sep, followed by the subsequent support of 1,530 pts. Towards the upside, the nearest resistance is at 1557.50 pts, the high of 6 Sep, followed by 1,569.50 pts, the high of 14 Sep.

Source: RHB Securities Research - 17 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024