FCPO: Bullish Momentum Picking Up Pace

rhboskres

Publish date: Fri, 17 Sep 2021, 04:07 PM

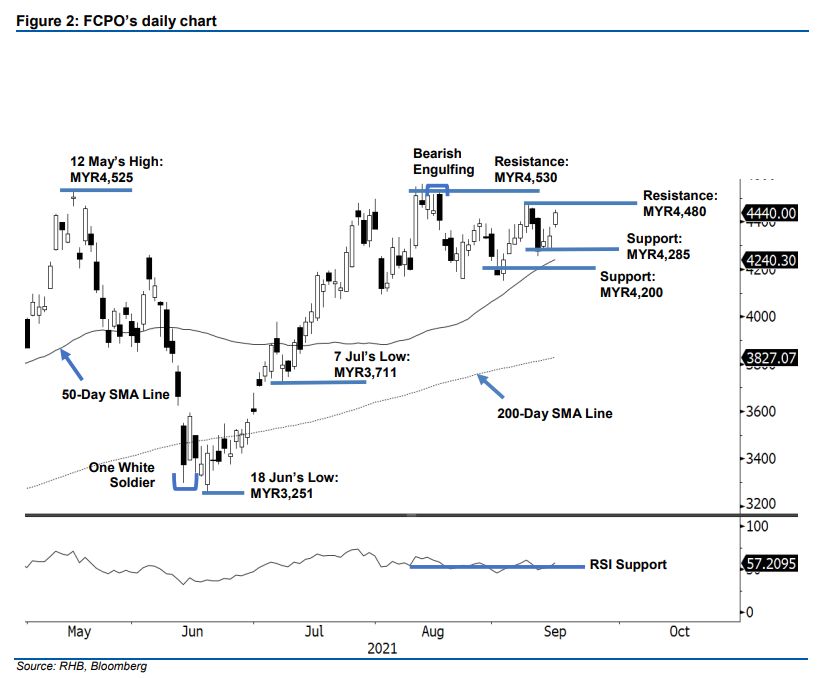

Stop-loss triggered; initiate long positions. Volatility on the FCPO picked up due to rollover activities – it surged by MYR100.00 to settle at MYR4,440. Initially, the commodity gapped up on Wednesday, starting the session stronger at MYR4,389. After touching the day’s low of MYR4,376, it progressed upwards further towards the day’s high of MYR4,450 before the close – breaching the previous resistance of MYR4,419. With the RSI pointing upwards, coupled with the 50-day SMA line trending higher, the positive technical setup may see the momentum follow through to test the MYR4,480 resistance level. Although the bulls are in control now, we do not rule out mild profit-taking activity in the coming session. We expect the MYR4,200 level to provide a strong downside support. Since the stop-loss has been breached, we shift over to a positive trading bias.

We close out the short positions initiated at MYR4,278, or the closing level of 10 Sep, after triggering the stop-loss set at MYR4,419. Conversely, traders can initiate long positions at the closing level of 15 Sep, ie. MYR4,440. To mitigate downside risks, the initial stop-loss is set at MYR4,200.

The first support is marked at MYR4,285 or the low of 14 Sep, followed by MYR4,200. The nearest resistance is at MYR4,480 – the high of 8 Sep – followed by MYR4,530, or the high of 17 Aug.

Source: RHB Securities Research - 17 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024