WTI Crude : Bulls Are Still in Control

rhboskres

Publish date: Fri, 17 Sep 2021, 04:15 PM

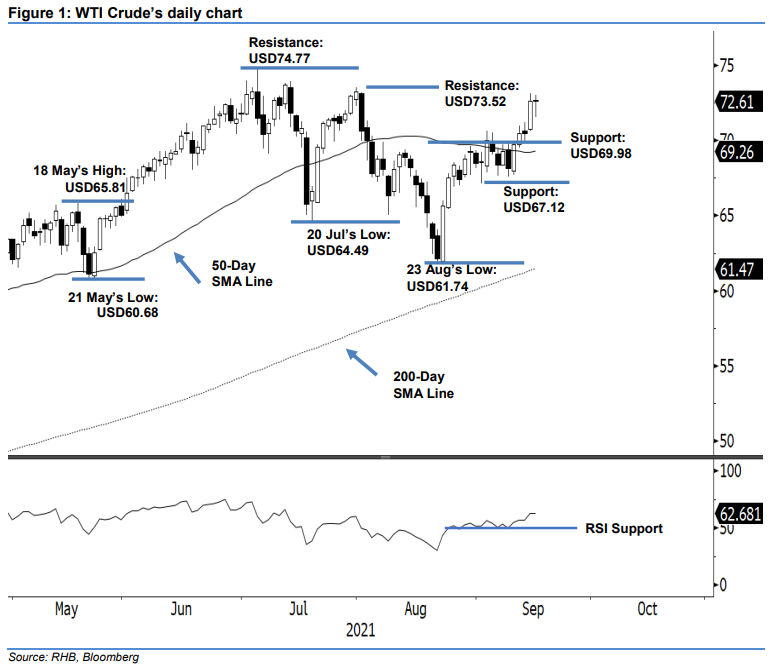

Keep long positions. After moving higher on Wednesday, the WTI Crude pared Thursday’s intraday losses to close at USD72.61 again. It opened at USD72.65 and whipsawed sideways before falling towards the day’s low of USD71.53, early in the US trading session. However, the selling pressure was short lived, with the index bouncing off strongly to recoup all its intraday losses to settle at Wednesday’s close. The latest neutral doji candlestick with long lower shadows – formed following Wednesday’s bullish momentum – indicates that the bulls are still set to propel towards the immediate resistance level. Nevertheless, we do not discount the possibility of mild profit-taking activities in the immediate term. With the RSI inching higher, above the 60% level, the medium-term bullish momentum is expected to persist. As such, we stick to our bullish trading bias.

Traders should stick to the long positions initiated at USD67.54 – the closing level of 24 Aug. To mitigate risks, the initial trailing-stop level is set at USD69.98, or 14 Sep’s low.

The immediate support level is revised to USD69.98, or 14 Sep’s low, followed by USD67.12, which was 1 Sep’s low. The resistance levels are fixed at USD73.52 – 30 Jul’s high – and USD74.77, which was 6 Jul’s high

Source: RHB Securities Research - 17 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024