COMEX Gold : Shifting to Negative Momentum

rhboskres

Publish date: Fri, 17 Sep 2021, 04:15 PM

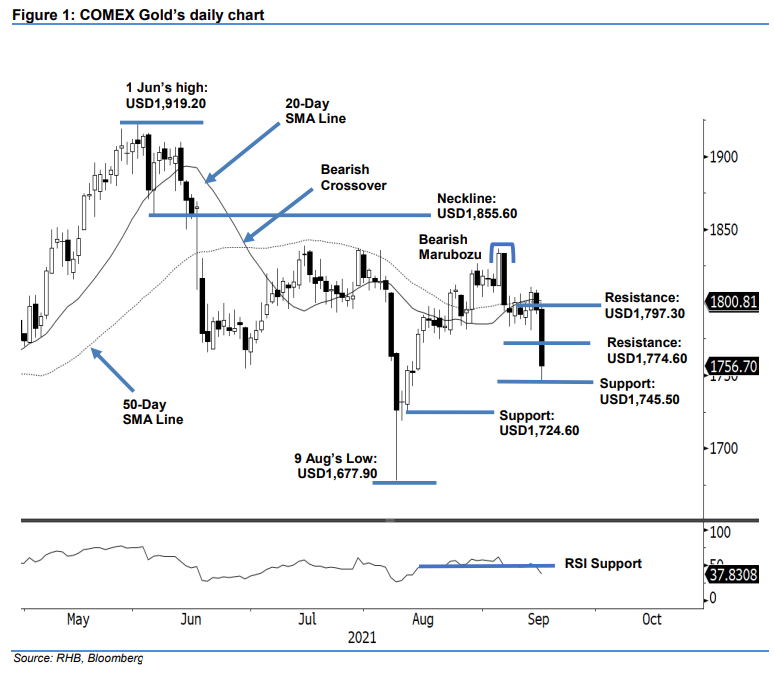

Trailing-stop triggered; initiate short positions. The COMEX Gold failed to hold on to the 20-day SMA line, and breached the USD1,790 support level. It plunged USD38.10 to settle at USD1,756.70. The commodity started Thursday’s session at USD1,795.50. Sentiment turned negative during the later part of the Asian trading hours, with the index plunging to the day’s low of USD1,745.50 before closing at USD1,756.70. The session printed a fresh “lower low” bearish pattern with a long black candlestick, indicating that the bears are back in control. With the RSI pointing downwards, negative momentum may follow through, sending the index lower to test the next immediate support at USD1,745.50. As the trailing-stop was breached, we shift to a negative trading bias.

We closed out the long positions initiated at USD1,778.20, or the closing level of 13 Aug, after the trailing-stop at USD1,790 was breached. Conversely, we initiate short positions at 16 Sep’s closing level of USD1,756.70. For risk management, the initial stop-loss is set at USD1,797.30.

The immediate support is revised to USD1,745.50 – 16 Sep’s low – followed by USD1,724.60 or 11 Aug’s low. The nearest resistance is revised to USD1,774.60 (19 Aug’s low), followed by USD1,797.30 (16 Sep’s high).

Source: RHB Securities Research - 17 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024