COMEX Gold: Bears Still in Control

rhboskres

Publish date: Mon, 20 Sep 2021, 08:52 AM

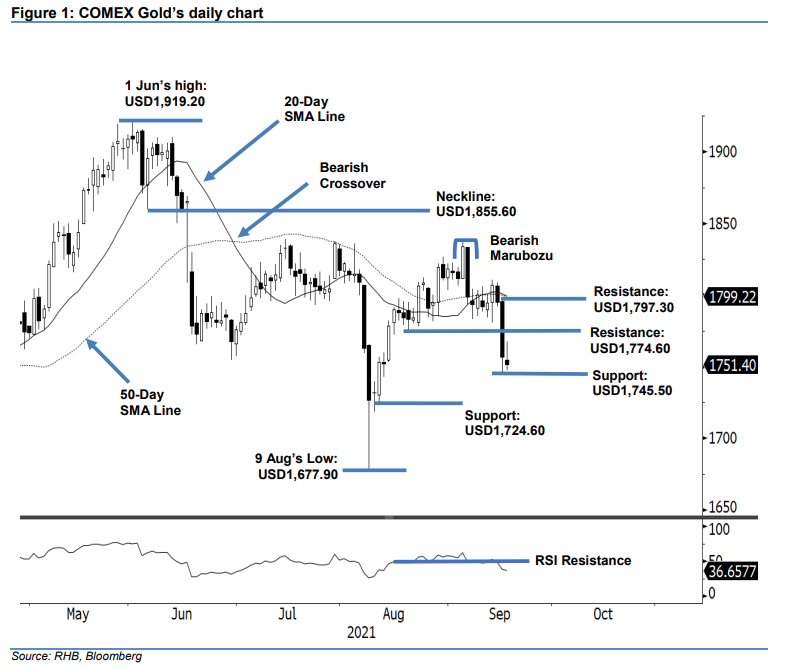

Maintain short positions. The COMEX Gold saw the bears still in control, declining USD5.30 to settle at USD1,751.40. The commodity began Friday’s session at USD1,754.60. It attempted to stage a rebound, rising to test the USD1,767.80 session high. Volatility picked up during the European trading session – with selling pressure emerging near the intraday high – bringing the commodity towards the USD1,747.10 session low. The COMEX Gold closed at USD1,751.40 after printing a black body candlestick with long upper shadow. It ended the week in negative territory, after posting a weekly loss of USD40.70 – and registering a 22-week low. It is now hovering near the USD1,750 psychological level. A breach of this level may see the yellow metal drifting lower to test the USD1,745.50, and subsequently USD1,724.60 support levels. We keep our negative trading bias.

We recommend traders maintain the short positions initiated at USD1,756.70 or the closing level of 16 Sep. To manage trading risks, the stop-loss is adjusted to USD1,785.

The immediate support is marked at USD1,745.50 or 16 Sep’s low, followed by USD1,724.60 or 11 Aug’s low. The nearest resistance is set at USD1,774.60 (19 Aug’s low), followed by USD1,797.30 (16 Sep’s high).

Source: RHB Securities Research - 20 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024