Hang Seng Index Futures: Bears Taking a Breather

rhboskres

Publish date: Mon, 20 Sep 2021, 08:58 AM

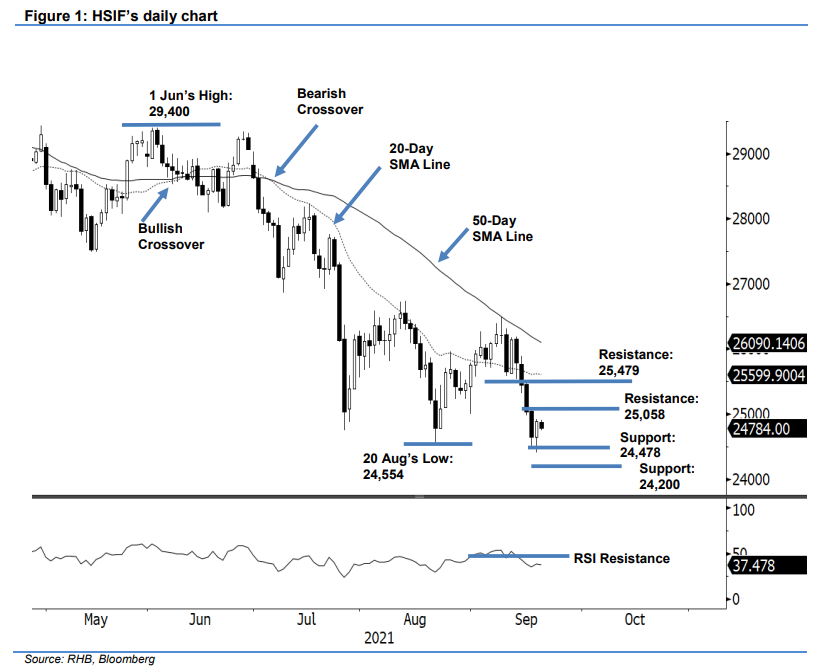

Maintain short positions. The HSIF saw the bears take a breather last Friday, rebounding 235 pts to settle the day session at 24,882 pts. It opened weaker at 24,650 pts. Sentiment was shaky during the early part of the session, with the index falling to the 24,406-pt day low. It then saw strong buying interest lift it to the 24,925-pt day high before the close. Mild profit-taking during the evening session saw the index retreat 98 pts, and was last traded at 24,784 pts. Although it printed a Hammer bullish pattern on Friday, the index recorded four consecutive negative sessions last week. With the 20-day SMA line trending below the 50-day SMA line, a downward trajectory is seen for the medium term. While we do not discount the index staging a counter rebound from the oversold region, we believe the 25,000- pt level will pose a strong psychological resistance. Hence, we maintain our negative trading bias.

Traders should stick with the short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To manage trading risks, the trailing stop is placed at 25,400 pts.

The nearest support is established at 24,478 pts – 16 Sep’s low – followed by the subsequent support level at 24,200 pts. The immediate resistance is pegged at 25,058 pts, or 16 Sep’s high, followed by 25,479 pts (15 Sep’s high).

Source: RHB Securities Research - 20 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024