WTI Crude: Mild Profit Taking

rhboskres

Publish date: Mon, 20 Sep 2021, 09:00 AM

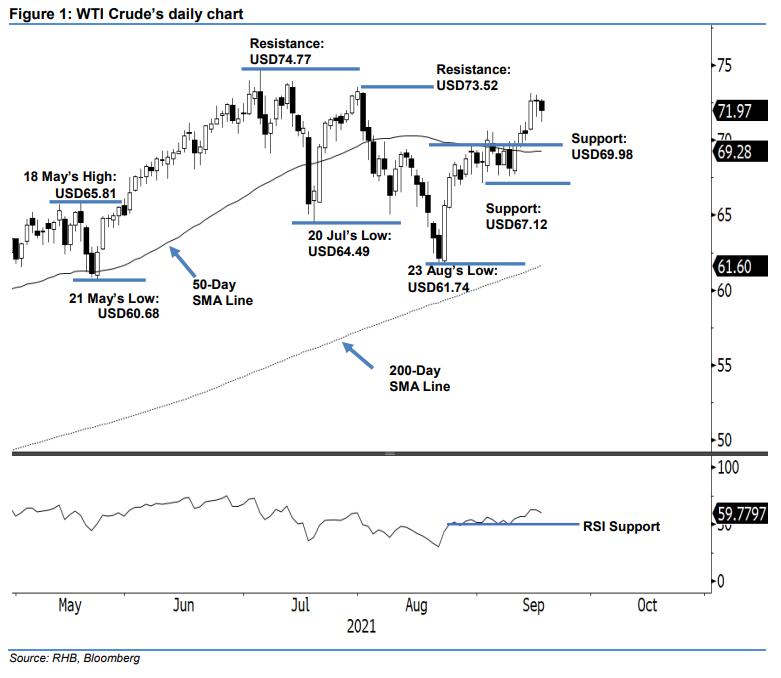

Keep long positions. After attempting to maintain near its recent peak last Thursday, the WTI Crude took a breather by taking profits last Friday – declining USD0.64 to settle at USD71.97. It opened at USD72.62 and touched the intraday high of USD72.72 before initiating the downtrend move – it hit the intraday low of USD71.21 before bouncing off to close. The latest black body candlestick with a lower shadow – formed following the recent “higher high” structure – signals selling pressure is mild and on course to propel towards the immediate resistance level of USD73.52. Yet, expect another mild profit-taking activity in the immediate term. Though the RSI is pointing lower, it is still showing strength above the 50% level – in line with the medium-term bullish momentum. Unless the selling pressure breaches the trailing-stop level, we stay with our bullish trading bias.

Traders should stay in the long positions initiated at USD67.54 – the closing level of 24 Aug. To mitigate risks, the initial trailing-stop level is placed at USD69.98, or 14 Sep’s low.

The support levels are maintained at USD69.98 – 14 Sep’s low – and USD67.12, 1 Sep’s low. The immediate resistance levels remain at USD73.52, or 30 Jul’s high, followed by USD74.77, ie 6 Jul’s high.

Source: RHB Securities Research - 20 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024