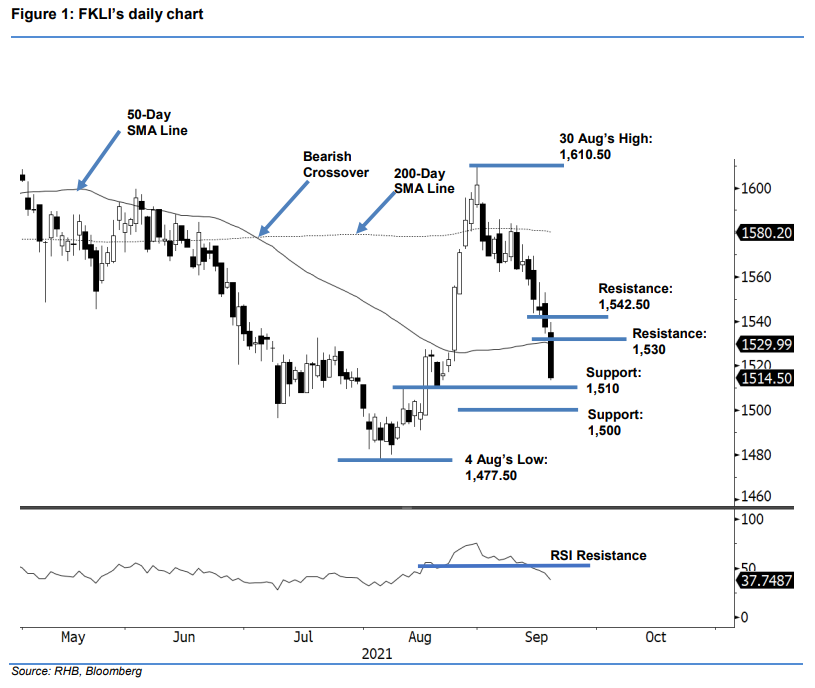

FKLI: Falling Below The 50-Day SMA Line

rhboskres

Publish date: Mon, 20 Sep 2021, 09:01 AM

Maintain short positions. The FKLI tracked the bearish sentiment on its Hong Kong peer yesterday, plunging 23 pts to close at 1,514.50 pts. It opened at 1,535 pts and briefly touched the day’s high of 1,539.50 pts. Investor jitters continued to affect the market, and the index dropped to the day’s low of 1,513.50 pts before closing, thereby printing a long bearish candlestick below the 50-day SMA line. Coupled with the RSI falling below 50% and pointing south, this downtrend may lead to the FKLI testing the 1,510-pt support level. The 1,510-pt level was also the breakout point on 17 Aug. Breaching the resistance-turned-support level will see the RSI falling into a oversold level. Traders can expect a technical rebound, when the RSI is in an oversold region. As the bears are still in play, we maintain a negative trading bias.

Traders should hold on short positions, which were initiated at 1,569.50 pts, or the close of 2 Sep. To manage risks, the trailing-stop is set at 1,539.50 pts.

The immediate support has been revised to 1,510 pts, the high of 11 Aug, followed by the 1,500-pt psychological level. Meanwhile, the nearest resistance is at 1,530 pts, then 1,542.50 pts or the low of 15 Sep.

Source: RHB Securities Research - 20 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024