FCPO: Breaching Below The MYR4,200 Mark

rhboskres

Publish date: Mon, 20 Sep 2021, 09:02 AM

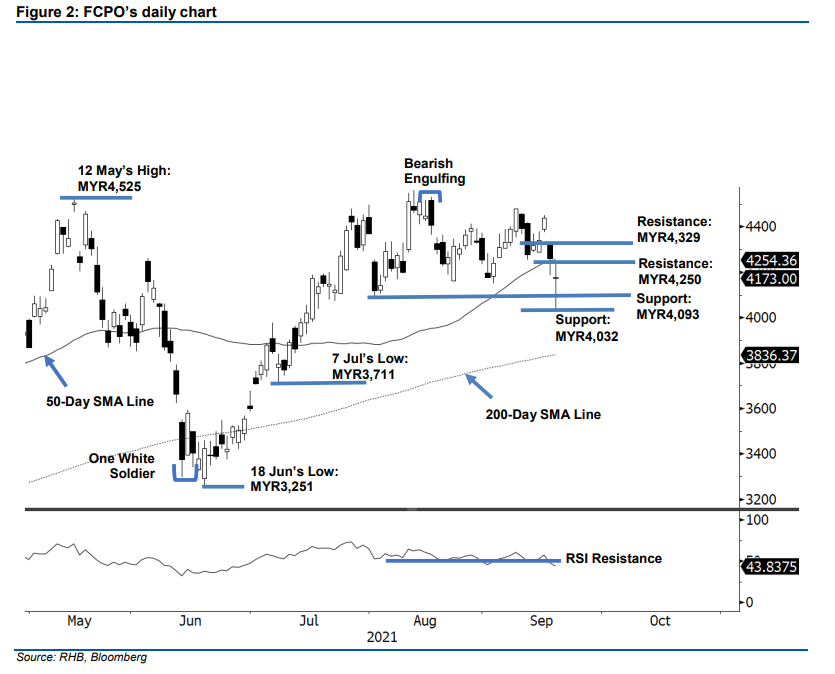

Stop-loss triggered; initiates short positions. The FCPO December futures contract failed to defend the support at MYR4,200, falling MYR88.00 to settle at MYR4,173. On Monday, the commodity opened at MYR4,176. As mentioned in previous note, MYR4,200 was a psychological level for the bulls. Breaching the critical threshold during the opening, saw the FCPO drop to hit the day’s low of MYR4,032. It then rebounded sharply to form an intraday long lower shadow and test the day’s high of MYR4,250. Despite a strong rebound during the midday, the commodity retreated in the afternoon and closed below the 50-day SMA line (MYR4,254). It may attempt to reclaim the 50-day SMA line in the coming sessions, but note that the RSI is falling below the 50% threshold – showing that the momentum is shifting into negative gear. Unless the bulls push the FCPO beyond the 50-day SMA line, the commodity will continue to undergo a correction and drift lower. Since the stop-loss has been breached, we switch over to a negative trading bias.

We closed out the long positions, which were initiated at MYR4,440 or the closing level of 15 Sep, after triggering the stop-loss at MYR4,200. Conversely, we initiate short positions at the closing level of 20 Sep, or MYR4,173. To manage the trading risks, the initial stop-loss has been fixed at MYR4,300.

The nearest support is marked at MYR4,093, the low of 2 Aug, followed by MYR4,032 or the low of 20 Sep. Towards the upside, the immediate resistance is at MYR4,250 – the high of 20 Sep – followed by MYR4,329 or the high of 17 Sep.

Source: RHB Securities Research - 20 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024