COMEX Gold: Bears Taking a Breather Near USD1,750

rhboskres

Publish date: Tue, 21 Sep 2021, 09:12 AM

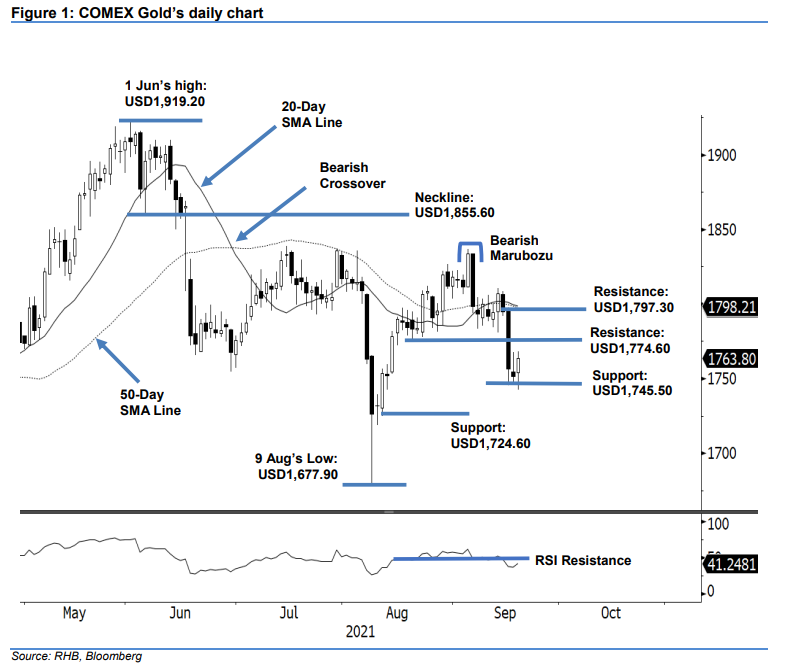

Maintain short positions. The COMEX Gold’s negative momentum failed to follow through yesterday, rebounding USD12.40 to settle at USD1,763.80. The commodity kicked-off Monday’s session at USD1,754.20. After establishing the intraday low at USD1,742.30, it rebounded to test the day’s high of USD1,768.40 ahead of the close. Strong buying interest emerged near the USD1,750 psychological level. If the positive momentum follows through, the bulls may attempt to test the USD1,774.60 support-turned-resistance level. A breach of this threshold may see sentiment turning positive again. Meanwhile, as both the 20-day and 50-day SMA lines are rounding downwards, downside risks persist, and the medium-term trend is weakening. As such, we retain our negative trading bias until the stop-loss is breached.

We recommend traders hold on to the short positions initiated at USD1,756.70 or the closing level of 16 Sep. To manage trading risks, the stop-loss is adjusted to USD1,780.

The immediate support is marked at USD1,745.50 or 16 Sep’s low, followed by USD1,724.60 or 11 Aug’s low. The nearest resistance is pegged at USD1,774.60 (19 Aug’s low), followed by USD1,797.30 (16 Sep’s high).

Source: RHB Securities Research - 21 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024