WTI Crude: Profit-Taking Continues Towards Immediate Support

rhboskres

Publish date: Tue, 21 Sep 2021, 09:21 AM

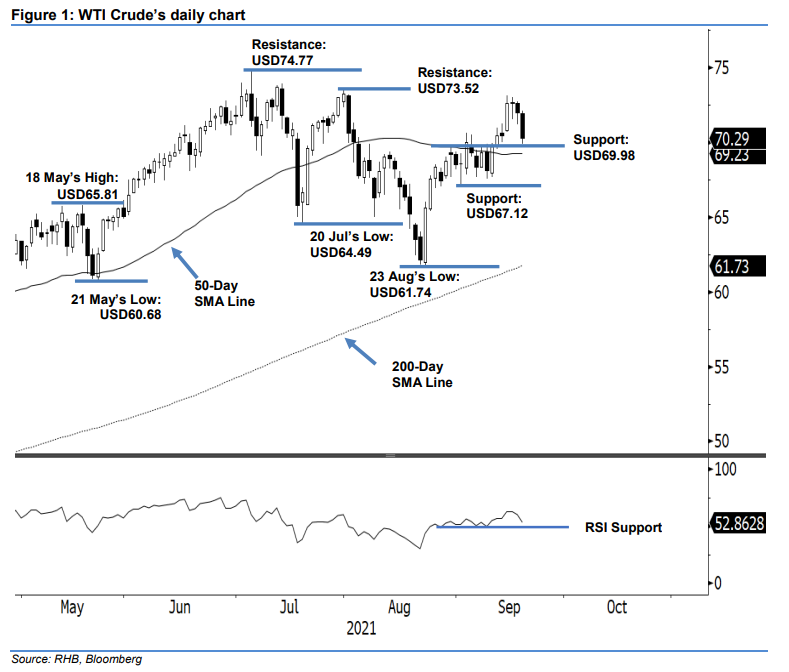

Maintain long positions. The WTI Crude continued to see profit-taking activity yesterday, falling USD1.68 to settle at USD70.29. It started at USD71.92 and immediately hit the day’s high of USD72.08 before shifting downwards for the rest of the session. It fell to the day’s bottom of USD69.86, later in the session, before bouncing off mildly to the close. The latest long black candlestick with a lower shadow – slightly above the immediate support level – indicates that profit-taking activity is capped by the immediate support. This is in line with our expectations, ahead of a rebound. Hence, we expect bullish momentum to re-emerge in the coming sessions, and the index to bounce off the USD69.98 support level. The RSI’s declining strength above the 50% level signals that the recent weakness is within the medium-term bullish momentum. As the trailing-stop remains intact, we stick to our bullish trading bias.

Traders should keep the long positions initiated at USD67.54, or the closing level of 24 Aug. To mitigate risks, the initial trailing-stop is pegged at USD69.98, or 14 Sep’s low.

The support levels are pegged at USD69.98, or 14 Sep’s low, and USD67.12, which was 1 Sep’s low. The immediate resistance level is still at USD73.52, or 30 Jul’s high, followed by USD74.77, which was 6 Jul’s high.

Source: RHB Securities Research - 21 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024