E-Mini Dow: Strong Bearish Momentum

rhboskres

Publish date: Tue, 21 Sep 2021, 09:22 AM

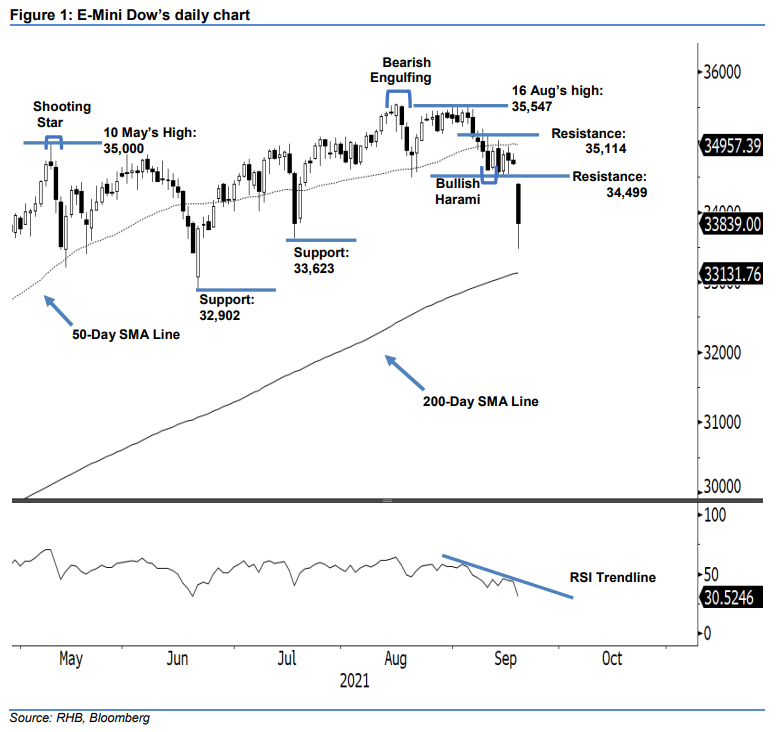

Keep short positions. The E-Mini Dow fell strongly by 857.8 pts yesterday, to close at 33,839 pts – dipping below the immediate support level. It opened with a negative gap at 34,400 pts, and touched the intraday high of 34,413 pts before continuing its bearish momentum towards the close. It hit the day’s low of 34,478 pts during the later part of the US trading session, before bouncing off 361 pts to close. The long black candlestick with a lower shadow indicates that the selling pressure below the 34,499-pt immediate support-turned-resistance level is imminent – and also solidifies our bearish medium-term outlook. This is coupled with the further weakening of the RSI towards the 30% level yesterday. Therefore, we maintain our bearish trading bias.

We suggest traders stick to their short positions, initiated at the closing level of 7 Sep, or 35,091 pts. To manage risks, the trailing-stop threshold is initiated at 34,499 pts – the immediate resistance.

The immediate support level is lowered to 33,623 pts, or 19 Jul’s low, followed by 32,902 pts, or 21 Jun’s low. The resistance levels are revised lower to 34,499 pts – which was 15 Sep’s low – and 35,114 pts, or 27 Aug’s low.

Source: RHB Securities Research - 21 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024