E-Mini Dow: Bearish Momentum Remains Intact

rhboskres

Publish date: Wed, 22 Sep 2021, 05:49 PM

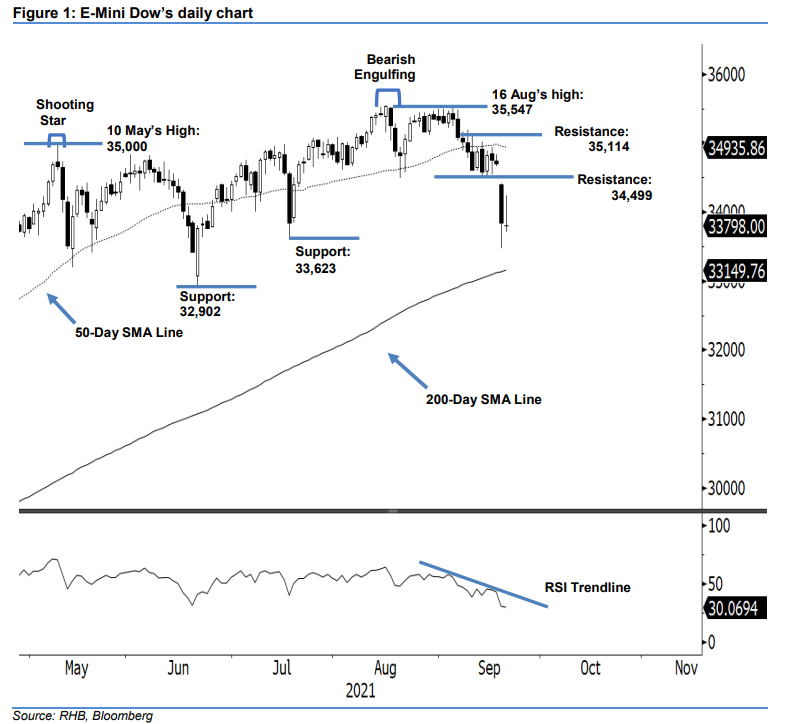

Maintain short positions. Despite attempting to move higher yesterday, the E-Mini Dow pared all its intraday gains to settle 41 pts lower at 33,798 pts – heading towards the 200-Day SMA line. It began on a negative tone at 33,806 pts, but buying pressure quickly emerged to propel the index towards the day’s high of 34,236 pts during Asian’s trading sessions. However, strong selling pressure appeared to drag the E-mini Dow towards the end of the US trading session as it hit the day’s bottom of 33,712 pts before the close. The neutral candlestick with a long upper shadow signals that selling momentum is imminent, with the expectation of a follow-through towards the 33,623-pt immediate support before reaching the 200-Day average line – this signifies our bearish medium-term outlook. With the continued weakening of the RSI at the 30% level, the bearish movement has become more pronounced. As such, we maintain our negative trading bias.

We suggest traders keep their short positions, initiated at the closing level of 7 Sep, or 35,091 pts. To manage risks, the trailing-stop level is placed at 34,499 pts, or the immediate resistance.

The immediate support level is fixed at 33,623 pts – 19 Jul’s low, followed by 32,902 pts – 21 Jun’s low. The resistance levels are fixed to 34,499 pts, or 15 Sep’s low, and 35,114 pts, ie 27 Aug’s low.

Source: RHB Securities Research - 22 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024