Hang Seng Index Futures: Downside Risk Remains

rhboskres

Publish date: Wed, 22 Sep 2021, 05:49 PM

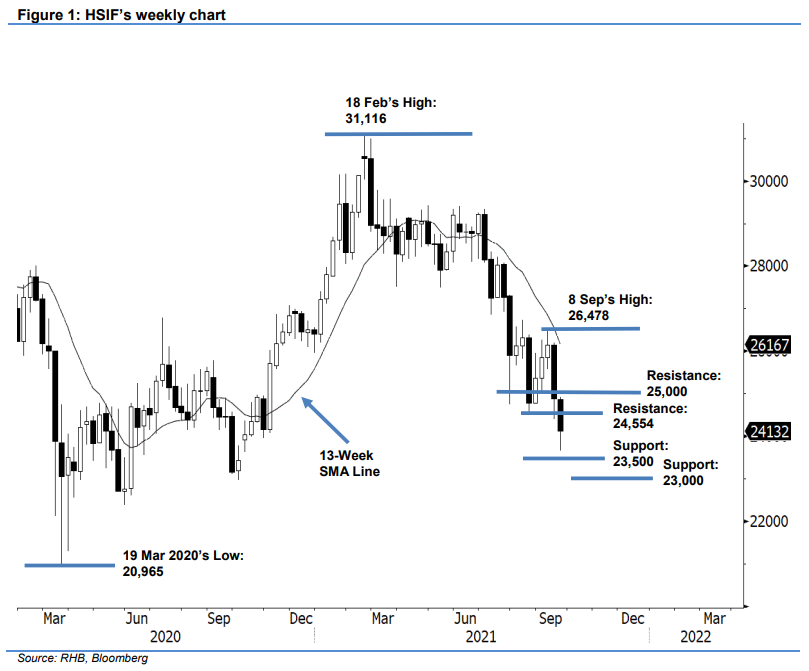

Maintain short positions. The HSIF’s weekly candlestick is trading on a downtrend, as it closed at 24,132 pts during the latest session. Observed since late June, the index has fallen below the 13-week SMA line and started its downward movement. With the index correcting lower, the 13-week SMA line has also begun turning down and trending lower. This shows the index will continue facing selling pressure for a longer term until it climbs above the moving average. Past records show too, the correction will end if the index is able to form a candlestick with a long lower shadow and bullsh reversal pattern. However, the index has yet to form any of these patterns. Hence, the HSIF is likely to continue drifting lower until it finds a stronger support. As such, we maintain our negative trading bias.

Traders are recommended to keep their short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To manage trading risks, the trailing-stop is placed at 24,800 pts.

For the near term, the immediate support is projected at 23,500 pts, followed by the lower support level at the 23,000- pt round figure. Meanwhie, the immediate resistance is pegged at 24,554 pts, or the low of 20 Aug, followed by the 25,000-pt psychological level.

Source: RHB Securities Research - 22 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024