WTI Crude: Bouncing Off the Immediate Support

rhboskres

Publish date: Wed, 22 Sep 2021, 05:50 PM

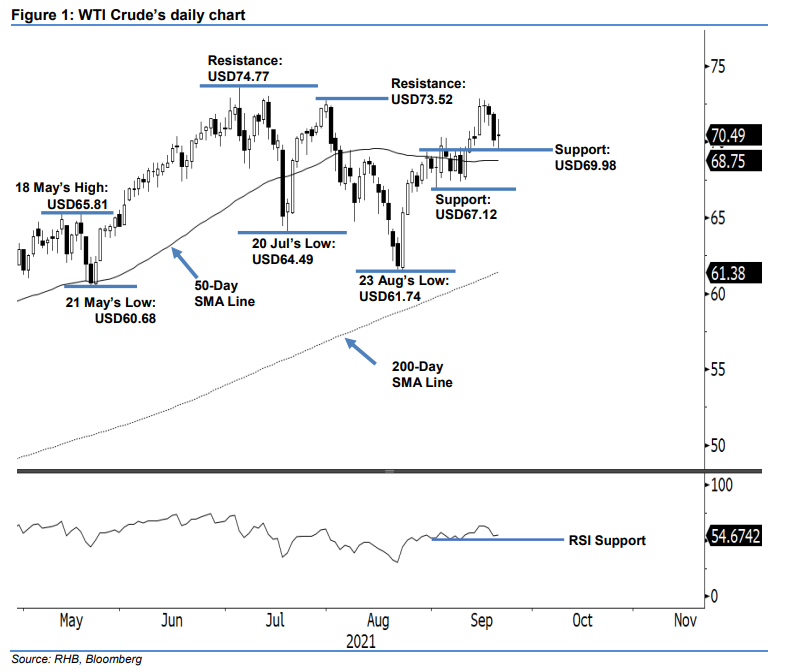

Keep long positions. The WTI Crude pared its intraday losses and inched up USD0.35 to close at USD70.49 yesterday, albeit, neutral against the opening. It started on a positive tone at USD70.43, and oscillated between the day’s high of USD71.48 and the day’s low of USD69.39 throughout the session – it bounced off the day’s low during early US trading to recoup its losses towards the close. The latest doji candlestick – where the lower shadow hits the immediate support – suggests that the crude oil may have found its footing, this is in line with our expectations earlier where profit-taking activity is capped by the immediate support before staging a rebound. With that, the bullish momentum is likely to re-emerge in the coming sessions towards the immediate resistance level. Supported by an improving RSI towards the 55% level, this signals the recovery of recent weakness towards stronger momentum ahead. Hence, we stick to our bullish trading bias, unless the trailing-stop is breached.

Traders should maintain long positions initiated at USD67.54 – the closing level of 24 Aug. To mitigate risks, the initial trailing-stop is placed at USD69.98, ie 14 Sep’s low.

The support levels are unchanged at USD69.98 – 14 Sep’s low, and USD67.12, or 1 Sep’s low. The immediate resistance level is pegged at USD73.52 – 30 Jul’s high, followed by USD74.77, or 6 Jul’s high.

Source: RHB Securities Research - 22 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024