WTI Crude: Bulls Emerge After Recent Pullback

rhboskres

Publish date: Thu, 23 Sep 2021, 05:11 PM

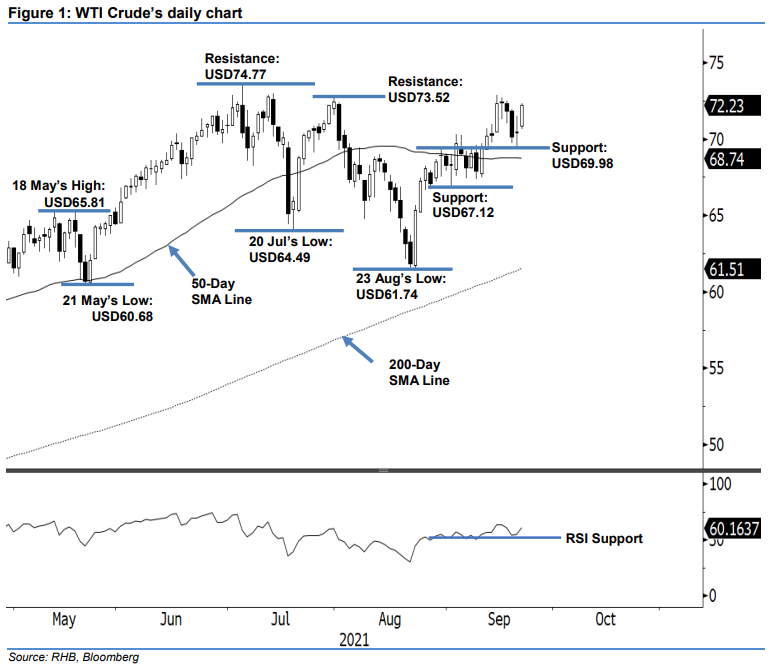

Maintain long positions. After bouncing off its support level on Tuesday, the WTI Crude jumped USD1.74 to settle at USD72.23 – close to its immediate resistance. It began on a positive note at USD70.85, and touched the day’s bottom of USD70.64 before bouncing off strongly towards the end of the session – it hit the day’s high of USD72.30 before retracing mildly to close. The latest bullish candlestick – moving away from the immediate support – signifies its solid footing and that the index is reclaiming its uptrend from recent pullback. With that, buying momentum is likely to follow through towards the immediate resistance level, before reaching the USD74.77 threshold. Coupled with the strengthening of the RSI towards the 60% level, this solidifies the re-emergence of bullish momentum towards stronger momentum ahead. As such, we keep our bullish trading bias.

Traders should keep the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage risks, the initial trailing-stop is set at USD69.98, or 14 Sep’s low.

The support levels are kept at USD69.98 – 14 Sep’s low – and USD67.12, which was 1 Sep’s low. The immediate resistance level is placed at USD73.52, or 30 Jul’s high, followed by USD74.77, which was 6 Jul’s high.

Source: RHB Securities Research - 23 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024