E-Mini Dow: Bouncing Off the Immediate Support

rhboskres

Publish date: Thu, 23 Sep 2021, 05:11 PM

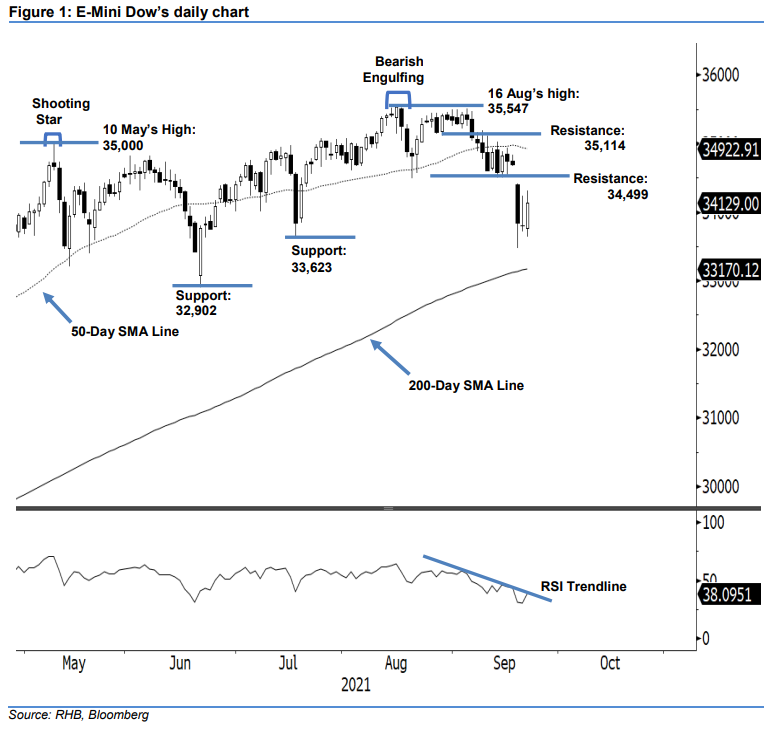

Keep short positions. Yesterday, the E-Mini Dow staged a reversal of momentum, as it bounced 331 pts higher to close at 34,129 pts – still below its immediate resistance threshold. It started lower at 33,761 pts, and touched the day’s low of 33,638 pts, ahead of the Asian trading session. Momentum swiftly reversed to positive, lifting the index for the rest of the session. It hit the day’s peak of 34,319 pts before retracing mildly to close. The bullish candlestick formed yesterday signals that strong buying pressure has emerged above the support level, solidifying its bottom. However, this positive momentum should be capped by the immediate resistance of 34,499 pts. Hence, we expect short-term volatility between the immediate resistance and support level in the immediate term, with the bearish medium-term outlook still intact. Despite the RSI strengthening yesterday, it remains weak, below the 40% level. We maintain our negative trading bias until the trailing stop is triggered.

We suggest traders stay in their short positions, initiated at the closing level of 7 Sep, or 35,091 pts. To manage risks, the trailing-stop threshold is set at 34,499 pts, which is the immediate resistance level.

The nearest support level is maintained at 33,623 pts (19 Jul’s low), followed by 32,902 pts (21 Jun’s low). The resistance levels are pegged at 34,499 pts, which was 15 Sep’s low, and 35,114 pts, or 27 Aug’s low.

Source: RHB Securities Research - 23 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024