COMEX Gold: Bears Back in Control

rhboskres

Publish date: Fri, 24 Sep 2021, 04:31 PM

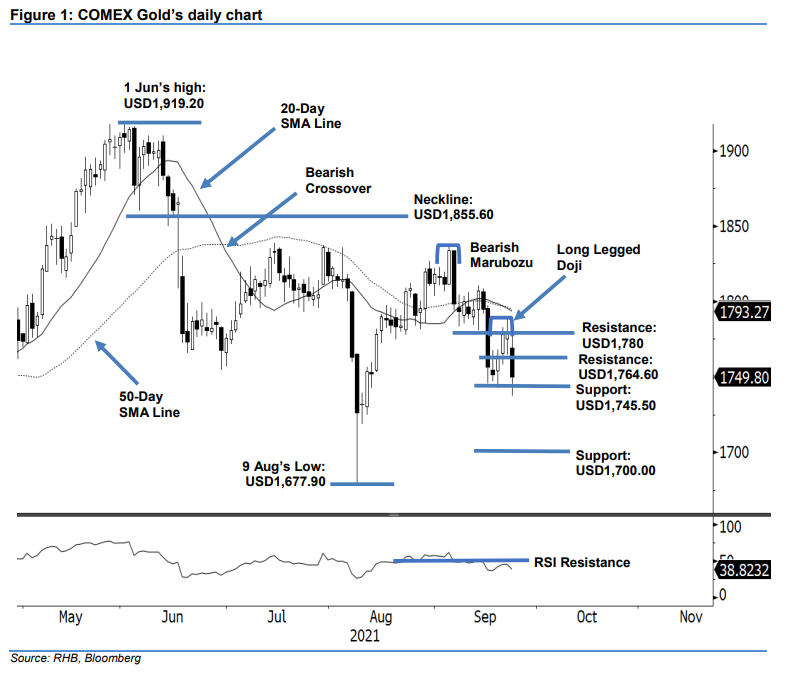

Maintain short positions. The COMEX Gold moved into negative momentum yesterday, falling significantly by USD29.00 to settle at USD1,749.80. The commodity opened lower at USD1,769.2 to trade lower before bouncing off higher towards the day’s high of USD1,777.10 during the European trading session. Selling pressure then emerged from the top to drag the yellow metal lower towards the USD1,737.50 low before retracing mildly to close. The long black candlestick hitting the USD1,745.50 support has pared down recent gains – between the USD1,745.50 support and USD1,780 resistance. As mentioned in the previous note, selling pressure may accelerate if it falls below USD1,764.60 – which has been breached. With the RSI weakening further, below the 40% threshold, the bears are expected to persist. As such, we stick to our negative trading bias.

Traders should keep to their short positions initiated at USD1,756.70 – the closing level of 16 Sep. To manage trading risks, the stop-loss is placed at USD1,780.

The first support is lowered to USD1,745.50, or the low of 16 Sep, followed by USD1,700 threshold. The immediate resistance is adjusted to USD1,764.80 – 22 Sep’s low, followed by USD1,780.

Source: RHB Securities Research - 24 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024