WTI Crude: Bulls Are in Control

rhboskres

Publish date: Fri, 24 Sep 2021, 04:35 PM

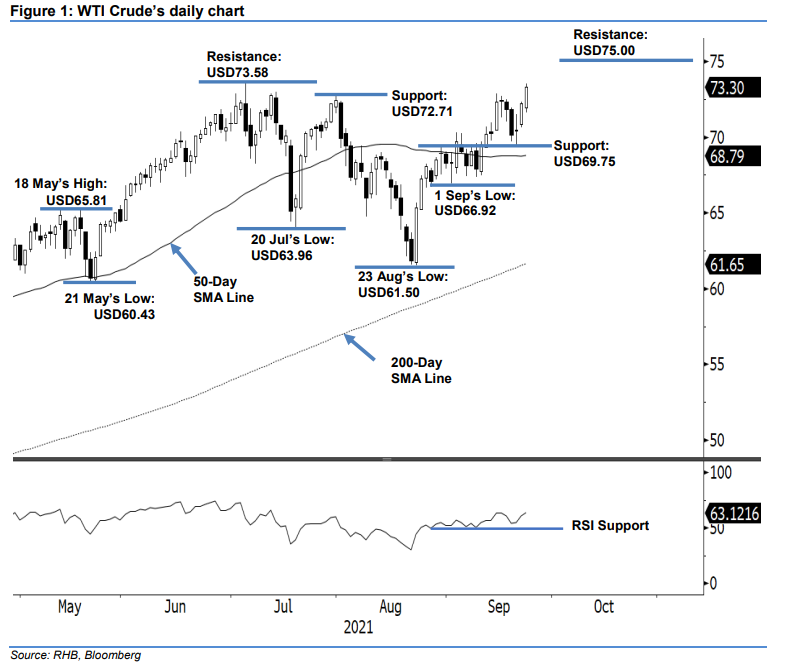

Keep long positions. The WTI Crude marked its third consecutive session of bullish momentum, rising USD1.07 to close at USD73.30 – breaching its immediate resistance. It opened lower at USD71.97, and then whipsawed upwards throughout the session, between the USD71.61 low and USD73.50 high. It retraced mildly from the peak before closing. The latest bullish candlestick – passing above the immediate resistance – solidifies its bullish momentum, and is expected to follow through in the coming sessions, to hit the USD73.58 and USD75.00 thresholds. Supported by the strengthening of the RSI above the 60% level, the bullish bias is anticipated to persist towards the next two resistance levels. With that, we keep our bullish trading bias.

Traders should maintain the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage risks, the initial trailing-stop is placed at USD69.75, or 14 Sep’s low.

The support levels are pegged at USD69.75 – 14 Sep’s low – and USD66.92, or 1 Sep’s low. The immediate resistance level is set at USD72.71, or 30 Jul’s high, followed by USD73.58, which was 6 Jul’s high.

Source: RHB Securities Research - 24 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024