FCPO: Mild Consolidation Before The Key Resistance

rhboskres

Publish date: Tue, 12 Oct 2021, 08:39 AM

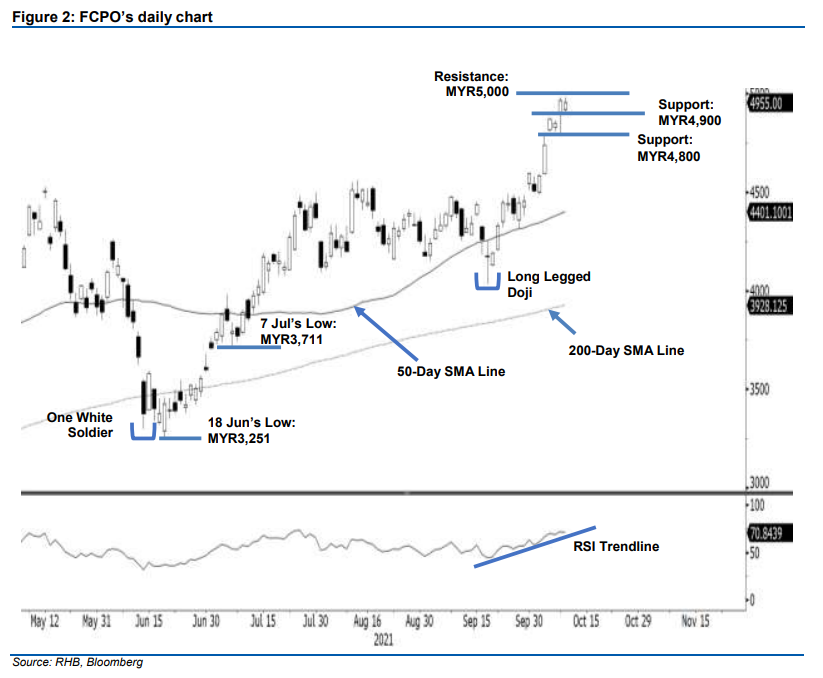

Maintain long positions. The FCPO saw mild profit-taking yesterday, and shed MYR11.00 to settle at MYR4,955. Yesterday, after it opened at MYR4,922, the commodity oscillated in a tight range of MYR4,981 and MYR4,907 before closing. The narrowbody candlestick showed the FCPO is consolidating just before the MYR5,000 resistance level. Crossing above the psychological level would attract follow-through buying interest. On the other hand, profit taking activities may continue to drag the commodity lower to retest the support levels of MYR4,900 and MYR4,800. As the RSI indicator still trending higher, the immediate-term positive momentum remains intact and the upside risk is very probable. So far, the bulls have not shown any sign of fatigue yet. As such, we make no change to our bullish trading bias.

Traders should remain in long positions, initiated at the closing level of 22 Sep or MYR4,330. To protect the downside risks, the trailing-stop is at the MYR4,800 mark.

The immediate support has been set at MYR4,900, followed by MYR4,800. The immediate resistance is eyed at the psychological level of MYR5,000, followed by MYR5,100, where both are in uncharted territory.

Source: RHB Securities Research - 12 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024