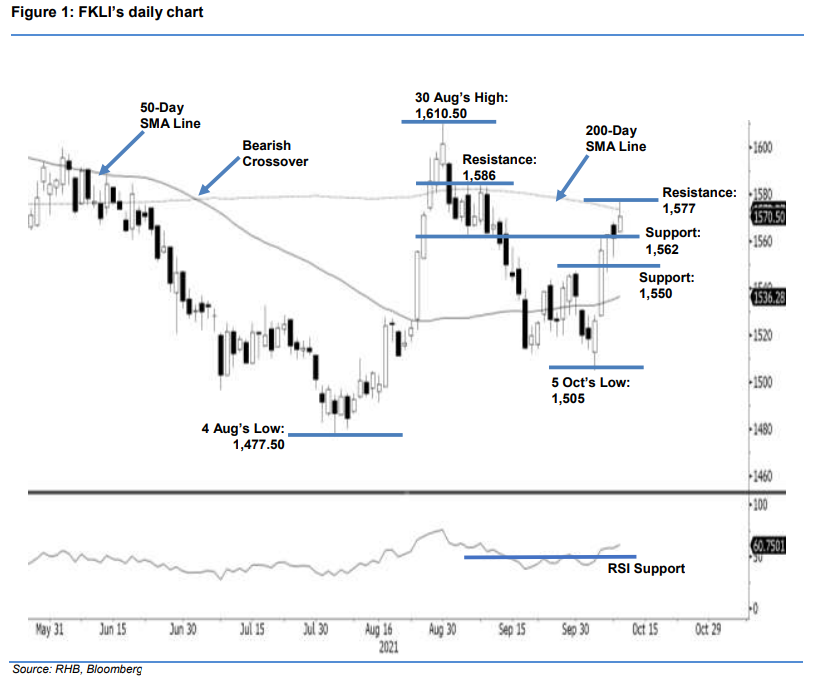

FKLI: Approaching 200-Day SMA Line

rhboskres

Publish date: Tue, 12 Oct 2021, 08:40 AM

Maintain long positions. The FKLI climbed higher in the first trading session of the week, rising 9 pts to close at 1,570.5 pts – getting nearer towards the overhead resistance of the 200-day SMA line. Yesterday, the index opened stronger at 1,564 pts. It advanced higher to test the intraday high of 1,577 pts, before closing – thereby printing a bullish candlestick with a shaved lower shadow. The bullish pattern indicates that the bulls are in control of the session and the uptrend remains intact – recording a fresh “higher high with higher low”. Although the index is climbing higher on positive momentum now, the bears may take profit near the 200-day SMA line in the immediate session. Expect a mild consolidation before the index breaches above the threshold. Meanwhile, the 1,562-pt level will act as the immediate support. Since the index is showing no sign of weakness, we make no change to our positive trading bias.

We recommend that traders stay in the long positions initiated at 1,556 pts or the closing level of 6 Oct. To minimise downside risks, the stop-loss has been adjusted upwards to 1,550 pts.

The nearest support has changed to 1,562 pts, followed by 1,550 pts. Conversely, the immediate resistance is at 1,577 pts or 11 Oct’s high, followed by 1,586 pts or the high of 6 Sep.

Source: RHB Securities Research - 11 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024