WTI Crude: Breaching Above the USD80.00 Level

rhboskres

Publish date: Tue, 12 Oct 2021, 08:40 AM

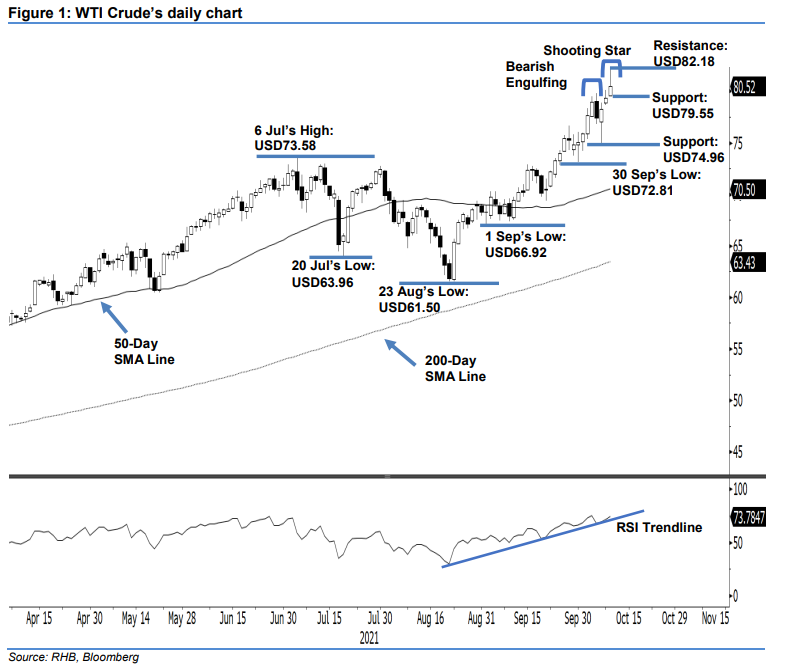

Maintain long positions. The WTI Crude continued to settle higher for a third consecutive session yesterday despite paring most of the intraday gains before the close. It settled USD1.17 higher at USD80.52. The commodity started higher by jumping to USD79.59 before gradually propelling itself nothwards – this saw it reach the day’s peak at USD82.18 during the European trading session. It then reversed direction, which saw the WTI Crude fall gradually at towards the USD79.55 day’s bottom before the close. The sharp intraday decline from the top has formed a “Shooting Star” candlestick – a bearish reversal signal – which indicates intense selling pressure from its intraday high. With the RSI strength showing a negative divergence against the price, the selling pressure is expected to follow through. Hence, we expect a correction to happen in the coming sessions before possibly reversing higher. Since the trailing-stop level has not been breached, we stick to our bullish trading bias.

We suggest traders keep the long positions initiated at USD67.54, or the closing level of 24 Aug. For trading-risk management, the trailing-stop threshold is placed at USD79.55, ie the revised immediate support.

The support levels are revised to USD79.55 – 11 Oct’s low – and USD78.63, or 8 Oct’s low. The resistance level is placed at USD82.18, ie 11 Oct’s high. Subsequently, a higher resistance is anticipated at the USD90.00 level.

Source: RHB Securities Research - 12 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024