FCPO: Profit-Taking Activities Extend

rhboskres

Publish date: Wed, 13 Oct 2021, 04:53 PM

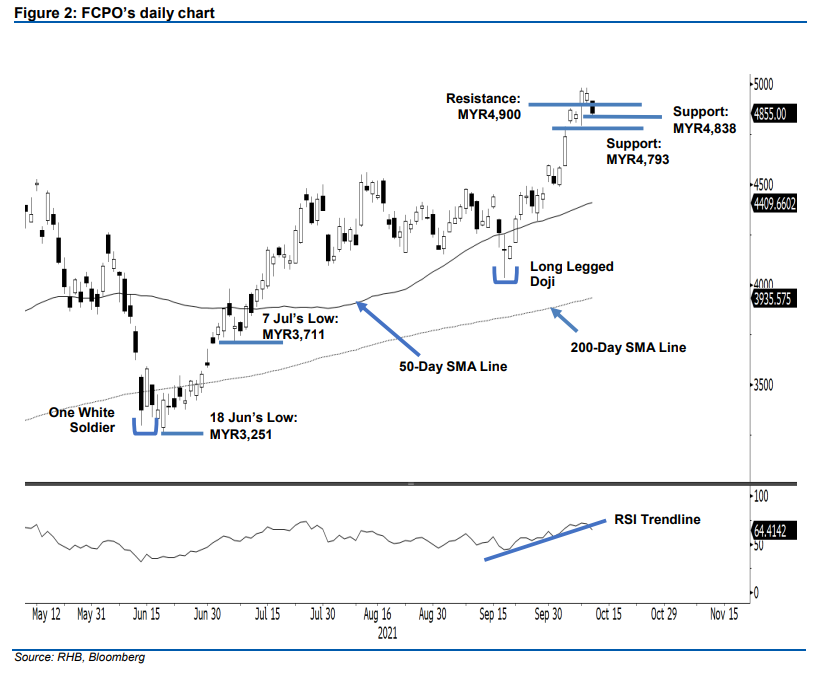

Maintain long positions. Profit-taking activities on the FCPO were extended yesterday, and the commodity shed MYR100.00 to settle at MYR4,855. It opened weaker, at MYR4,915. Cautious sentiment saw the commodity undergoing a correction, and it fell to the session’s low of MYR4,838 before the close. The RSI is turning down from the 70% level, showing that the bulls are taking a breather after a strong rally recently. The bullish momentum may pick up again when the commodity is bouncing off the support level. Meanwhile, for the immediate term, we expect the commodity to find its support near the MYR4,838 level. If this level gives way, there is a risk that a bearish reversal pattern may be formed – the FCPO may see a further downward correction until a candlestick with a long lower shadow is formed. At this stage, we believe the upside risks remain in place, and maintain a bullish trading bias until the revised trailing-stop has been breached.

Traders should remain in long positions, initiated at the closing level of 22 Sep or MYR4,330. To manage trading risks, the trailing-stop has been raised to MYR4,838.

We revise the immediate support to MYR4,838 or the low of 12 Oct, followed by MYR4,793 ie the low of 8 Oct. Meanwhile, the immediate resistance is set at MYR4,900, followed by the MYR5,000 psychological mark.

Source: RHB Securities Research - 13 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024