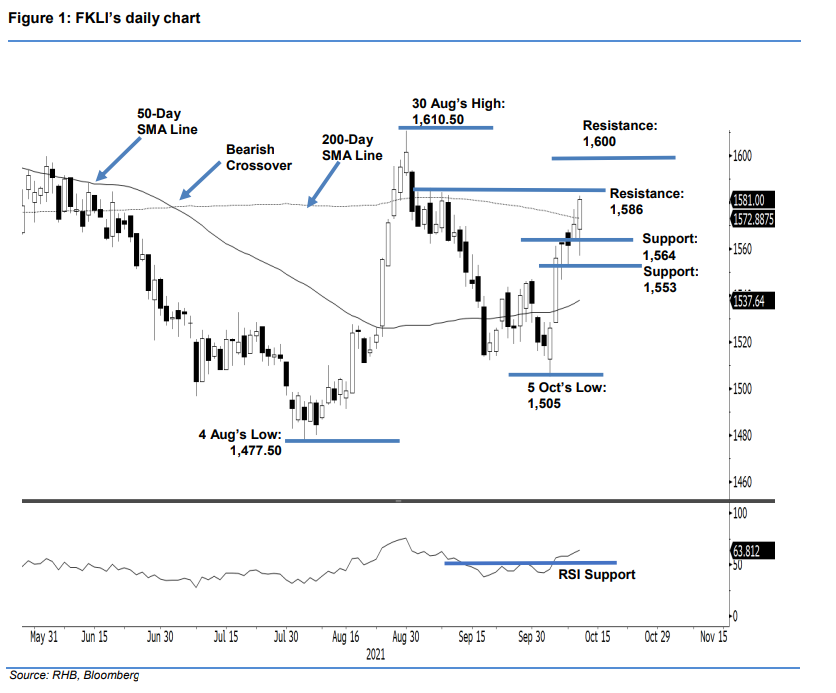

FKLI: Breaching Above The 200-Day SMA Line

rhboskres

Publish date: Wed, 13 Oct 2021, 04:53 PM

Maintain long positions. The FKLI broke past the 200-day SMA line on strong momentum, advancing 10.50 pts to settle at 1,581 pts yesterday. It opened at 1,568.50 pts. The bulls were nervous initially, when the index retreated to the day’s low of 1,557 pts. After that, it swiftly rebounded and moved upwards throughout the session, touching the day’s high of 1,582.50 pts before the close. The latest session saw the FKLI extending its uptrend, as it printed a fresh “higher high” bullish pattern. With the index having crossed the moving average line, the recent upward movement has been further strengthened.

Traders can expect a follow-though price action to test the 1,586-pt resistance. In the event the bears decide to take profits, strong support is near 1,564 pts. We maintain our positive trading bias. Traders should remain in long positions, initiated at 1,556 pts or the closing level of 6 Oct. To mitigate the downside risks, the stop-loss is at 1,550 pts.

The nearest support is at 1,564 pts (the low of 11 Oct), followed by 1,553 pts (the low of 8 Oct). Towards the upside, the immediate resistance is at 1,586 pts ie the high of 6 Sep, followed by the 1,600-pt psychological level.

Source: RHB Securities Research - 13 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024