E-Mini Dow : Profit Taking Continues

rhboskres

Publish date: Wed, 13 Oct 2021, 04:54 PM

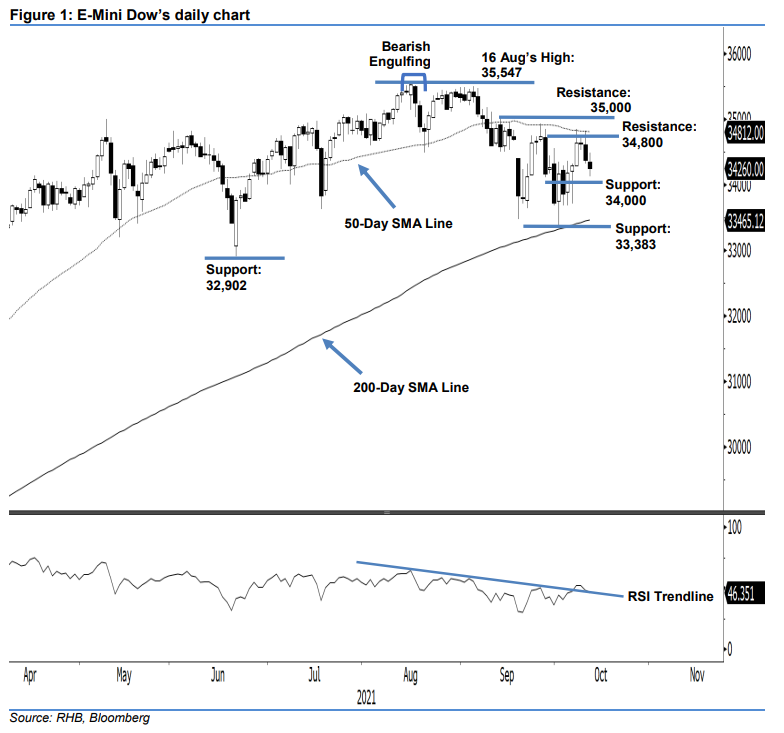

Still long positions. The E-Mini Dow resumed its correction yesterday by falling 116 pts lower to settle at 34,260 pts. The index opened lower at 34,356 pts and whipsawed in a negative direction throughout the session, which saw it drag towards the day’s low of 34,125 pts before reversing higher towards the day’s high of 34,486 pts. It then spiralled downwards to settle below the previous day’s close. The latest bearish candlestick with the upper and lower shadows indicates the continuation of the recent bearish momentum – heading towards the 34,000-pt immediate support. Since the RSI strength is still declining below the 50% level, we expect further profit taking ahead before reversing higher in the medium term. If it manages to rebound above the immediate support level, a “higher low” bullish structure may be formed, thereby renewing its bullish momentum for the medium term. As such, we keep to our positive trading bias, until the stop-loss is breached.

We suggest traders maintain the long positions we initiated at the closing level of 7 Oct, or 34,638 pts. To manage the trading risks, the initial stop-loss threshold is pegged at the 34,000-pt level.

The nearest support level is fixed at the 34,000-pt round figure and is followed by 33,383 pts, ie 1 Oct’s low. The immediate resistance is set at 34,800 pts, followed by the 35,000-pt psychological level.

Source: RHB Securities Research - 13 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024