FCPO: Charts New Record High

rhboskres

Publish date: Thu, 14 Oct 2021, 08:29 AM

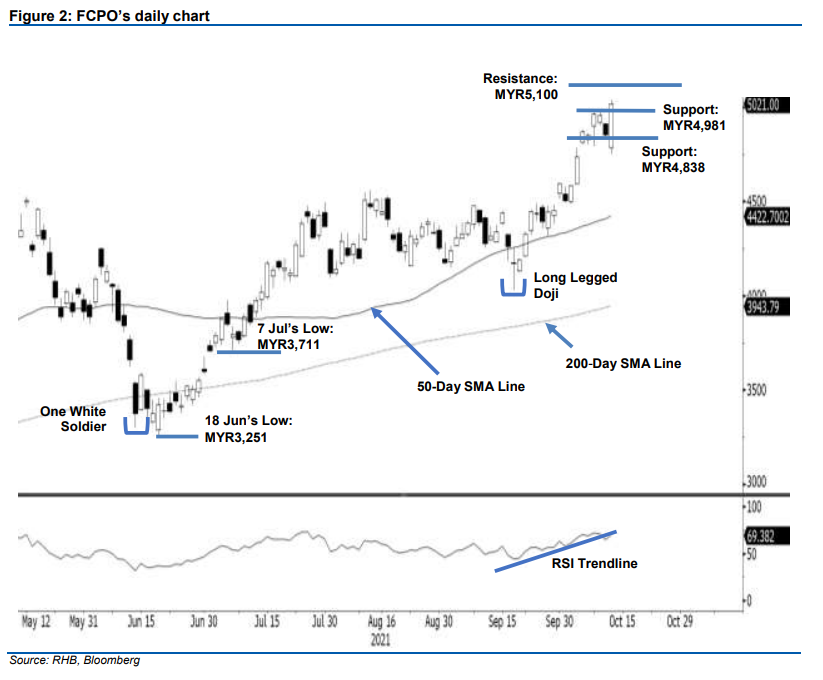

Maintain long positions. The FCPO rebounded strongly from the support level yesterday, jumping MYR166.00 to settle at MYR5,021. Initially, it gapped down and opened weaker at MYR4,787. After touching the day’s low of MYR4,753, the commodity rose to recoup intraday losses. Sentiment turned positive again, when the commodity regained the support of the MYR4,838 level. Strong buying interest lifted the commodity in the afternoon session to reach the day’s high of MYR5,039, before the historic close of MYR5,021 – this is the first time the 3 rd month futures contract closed above MYR5,000. As we anticipated earlier, the commodity reacted positively towards its support level of MYR4,838. The strong rebound from the support level suggests that the bulls are back in the driver’s seat. Expect a follow-through price action to test the upside resistance of MYR5,100, followed by MYR5,150. Meanwhile, MYR4,838 will remain as a major support for the coming sessions. With the bullish momentum in sight, we make no change to our positive trading bias.

Traders should stick to long positions, initiated at the closing level of 22 Sep or MYR4,330. To manage the downside risks, the trailing-stop is placed at MYR4,838.

The immediate support has been to MYR4,981 (the high of 8 Oct) and followed by MYR4,838, or the low of 12 Oct. Towards the upside, the immediate resistance is projected at MYR5,100, followed by the MY5,150 mark.

Source: RHB Securities Research - 14 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024