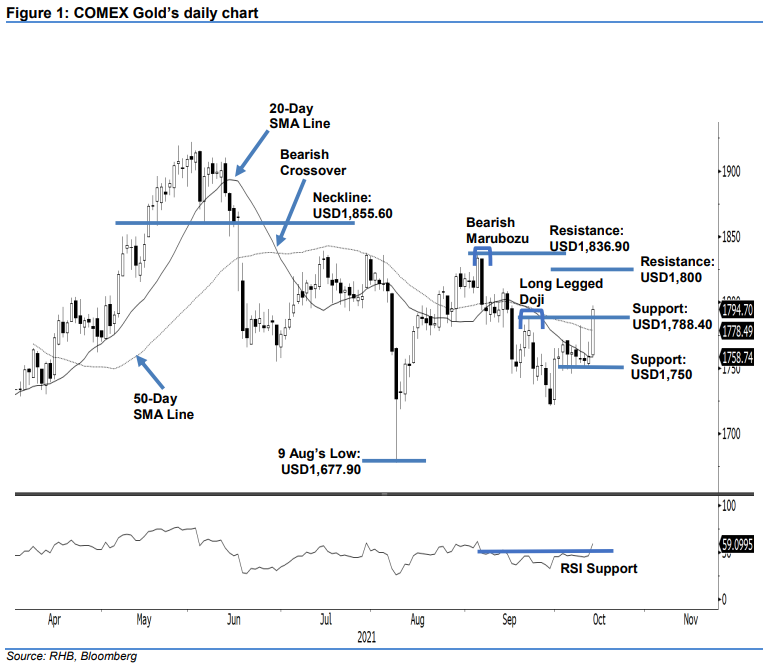

COMEX Gold: Breaking Past the 20-Day SMA Line

rhboskres

Publish date: Thu, 14 Oct 2021, 08:36 AM

Maintain long positions. The COMEX Gold broke past the 20-day SMA line amid strong buying interest yesterday, surging USD35.40 to settle at USD1,794.70. Yesterday, the commodity initially opened at USD1,760.40 and moved sideways for most of the session. Volatility picked up when the US released September’s CPI numbers, which saw the commodity dive to the day’s low of USD1,757.90, before making a sharp rebound towards the upside – touching the day’s high of USD1,797.40 and closing at USD1,794.70. The latest session saw the commodity crossing both the 20-day and 50-day SMA lines – and in progress towards registering a 4-week high. If it sustains above the USD1,788.40 immediate support, the bulls may attempt to reclaim the 1,800-pt psychological level. At this stage, the COMEX Gold has printed a fresh “higher high” and with the renewed momentum, we are keeping to our positive trading bias.

Traders should retain their long positions initiated at USD1,767.60, or the closing level of 4 Oct. To manage the trading risks, the trailing stop is set at USD1,775.

The immediate support is revised to USD1,788.40 – 22 Sep’s high – followed by USD1,750. The nearest resistance is eyed at USD1,800, and followed by USD1,836.90, or 3 Sep’s high.

Source: RHB Securities Research - 14 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024