FCPO: Profit-Taking And Consolidation

rhboskres

Publish date: Fri, 15 Oct 2021, 04:39 PM

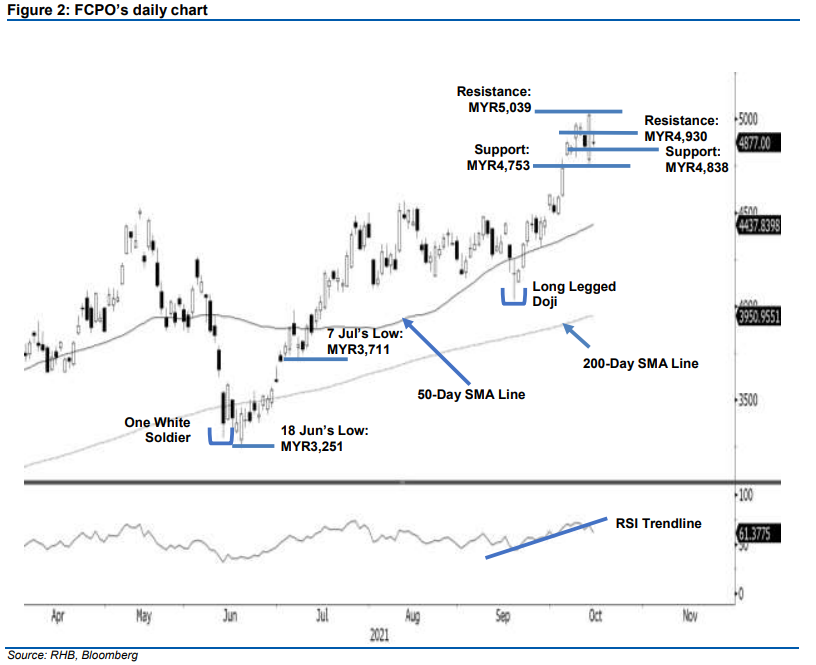

Maintain long positions. Strong profit-taking activity yesterday led the FCPO to decline by MYR144.00 to settle at MYR4,877. One day before 15 Oct’s rollover of futures contracts, the commodity gapped down and opened weaker at MYR4,872. The bulls attempted to climbed higher, but efforts were capped at the day’s high of MYR4,930. After touching the day’s low of MYR4,850, the commodity rebounded mildly to close at MYR4,877. In the coming sessions, if it breaches the MYR4,838 immediate support, this may attract follow-through selling pressure. Towards the upside, the immediate resistance is spotted at MYR4,930. The FCPO may attempt to breakout from either boundary to form its next trend. Pending the breakout of price action, it should continue to trend sideways. At this stage, we believe upside risk remains and maintain a positive trading bias.

Traders should keep to long positions, initiated at the closing level of 22 Sep or MYR4,330. To control the downside risks, the trailing-stop is fixed at MYR4,838.

The nearest support sighted at MYR4,838 (the low of 12 Oct) and followed by MYR4,753, or the low of 13 Oct. Toward the upside, the immediate resistance is pegged at MYR4,930 or the high of 14 Oct, followed by the MY5,039 or the high of 2021.

Source: RHB Securities Research - 15 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024