FKLI: Falling Back Below 1,600-Pt Level

rhboskres

Publish date: Fri, 15 Oct 2021, 04:40 PM

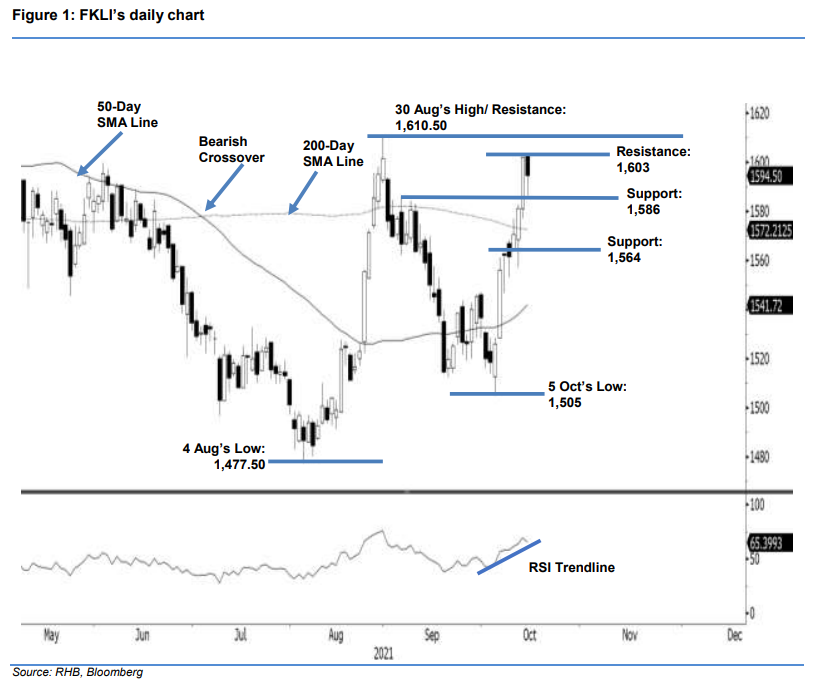

Maintain long positions. After a strong rally for three consecutive sessions, the FKLI corrected for the first time as investors took profit. It retraced by 7.50 pts to close at 1,594.50 pts. Initially, the index gapped up on positive sentiment, opening stronger at 1,603 pts. However, the bears decided to take profit, and the bullish momentum tapered to touch the day’s low of 1,586 pts, before rebounding mildly to close at 1,594.50 pts. Despite recent selling activities, the index still printed a “higher low” bullish pattern. As long as it stays above the 200-day SMA line, we believe that the bullish structure that started since crossing of 50-day SMA line should remain intact – the index may resume its upward movement post profit-taking activities. Meanwhile, expect 1,564 pts to act as a strong downside support. As such, we maintain our positive trading bias until the trailing-stop is triggered.

We recommend that traders stick to long positions, which were initiated at 1,556 pts or the closing level of 6 Oct. To mitigate trading risks, the trailing-stop is set at 1,564 pts.

The nearest support is marked at 1,586 pts (the high of 6 Sep) followed by 1,564 pts (the low of 11 Oct). Meanwhile, the immediate resistance is pegged at 1,603 pts, ie the high of 14 Oct, then 1,610.50 pts or the high of 30 Aug.

Source: RHB Securities Research - 15 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024