WTI Crude : Bouncing Off Moderately

rhboskres

Publish date: Fri, 15 Oct 2021, 04:47 PM

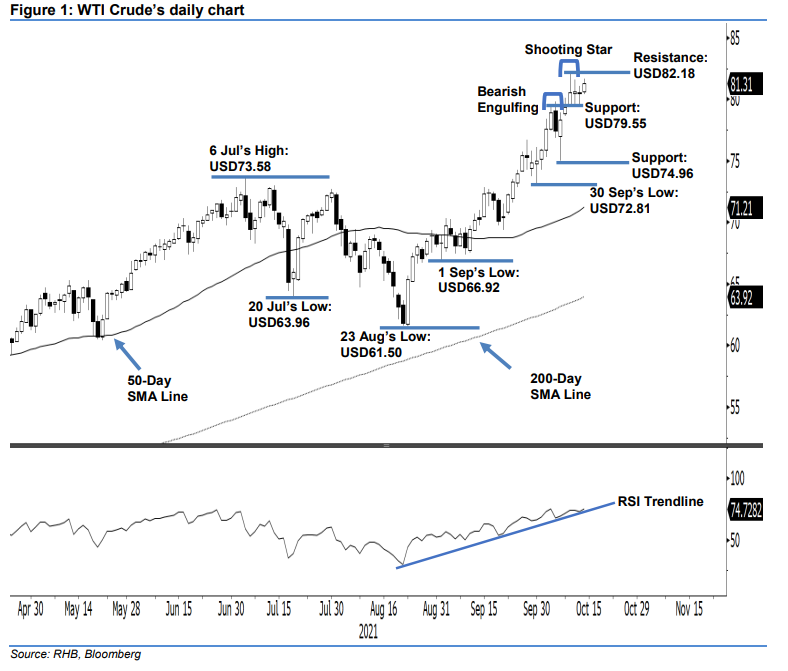

Maintain long positions. The WTI Crude bounced off positively yesterday as it settled USD0.87 higher at USD81.31. The commodity began on a positive tone at USD80.59 and gradually moved up towards the day’s peak at USD81.68 following the opening of the US trading session. However, it then abruptly shifted towards the south by hitting the day’s low of USD80.38 before strongly regaining its bullish momentum to reclaim above its opening at the close. The white body candlestick indicates that the renewed bullish momentum is likely to hit the USD82.18 resistance in the coming sessions before jumping higher – ie higher odds for an upwards movement. Supported by the RSI strength pointing higher again above the 70% level, the bullish momentum may follow-through towards the immediate resistance level. Unless the trailing-stop is breached, we keep to our bullish trading bias.

We recommend traders stick to their long positions initiated at USD67.54, or the closing level of 24 Aug. For trading-risk management, the trailing-stop threshold is set at USD79.55, or the immediate support.

The support levels remain unchanged at USD79.55 – 11 Oct’s low – and USD74.96, or 7 Oct’s low. The resistance level is pegged at USD82.18, or 11 Oct’s high. Subsequently, a higher resistance is eyed at the USD90.00 level.

Source: RHB Securities Research - 15 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024