COMEX Gold : Bullish Momentum Gaining Traction

rhboskres

Publish date: Fri, 15 Oct 2021, 04:52 PM

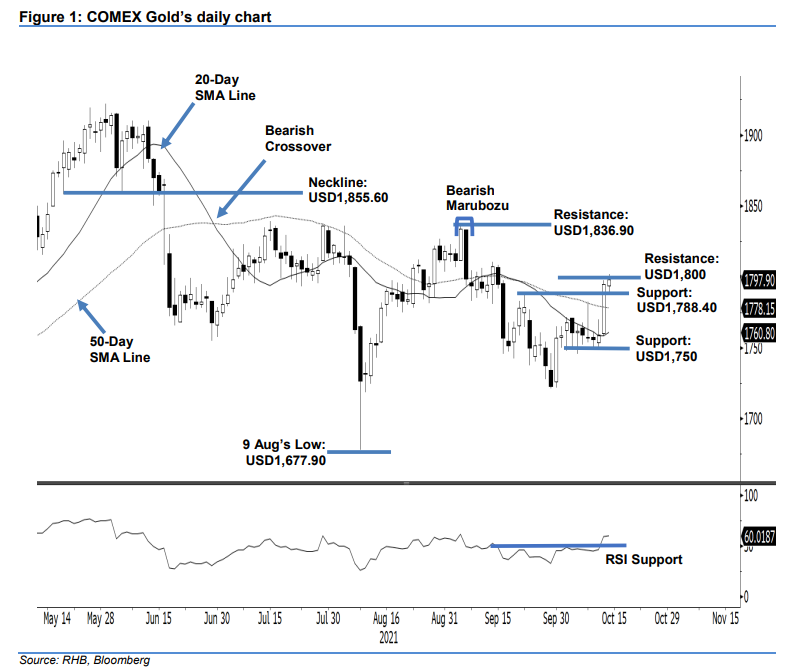

Maintain long positions. The COMEX Gold saw extended bullish momentum yesterday, climbing USD3.20 to settle at USD1,797.90. Following Wednesday’s bullish session, it started off on a positive note yesterday, opening stronger at USD1,793.60. Although it dipped mildly to test the session’s low of USD1,787.60, buying interest near the USD1,788.40 immediate support level lifted the index to the USD1,801.90 session high before the close. The bulls are now looking to cross the USD1,800 psychological level. Over the last six months, the commodity has been gyrating near 1,800 pts – a breach above this threshold will see market sentiment improve. If the bears decide to take profit, the commodity may retrace to test its downside support at USD1,788.40 pts. Deeper profit-taking may see the COMEX Gold retest the 50-day SMA line. For now, as bullish momentum is gathering strength, we keep our positive trading bias.

Traders are recommended to stick to the long positions initiated at USD1,767.60, or the closing level of 4 Oct. To manage downside risks, the trailing stop is placed at USD1,775.

The immediate support is marked at USD1,788.40 – 22 Sep’s high – followed by the USD1,750 round number. The nearest resistance is eyed at USD1,800, followed by USD1,836.90, or 3 Sep’s high.

Source: RHB Securities Research - 15 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024