WTI Crude: Still Charging Higher

rhboskres

Publish date: Mon, 18 Oct 2021, 08:51 AM

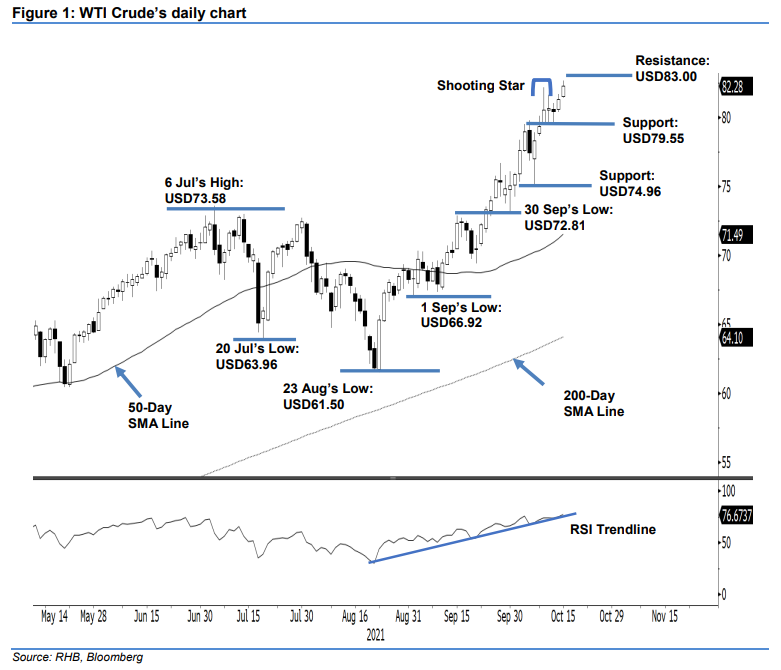

Maintain long positions. The WTI Crude edged higher on Friday amid buying interest, climbing USD0.97 to settle at USD82.28. The commodity began Friday’s session at USD81.48. It progressed higher and touched the USD82.66 intraday high during the US trading session. It then closed stronger at USD82.28, printing a bullish candlestick while negating the previous Shooting Star bearish pattern. The latest session showed that the bulls are still in control, and are not showing signs of fatigue yet. As long as the commodity stays above the USD79.55 immediate support level, we expect more legs on the upside. As such, we stick to our bullish trading bias until the trailing-stop is breached.

Traders should maintain the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage trading risks, the trailing-stop is placed at USD79.55, or the immediate support level.

The support levels remain at USD79.55 – 11 Oct’s low – and USD74.96, which was 7 Oct’s low. The resistance level is pegged at the USD83.00 round figure, followed by the higher resistance at USD90.00.

Source: RHB Securities Research - 18 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024