FKLI: Reclaiming The 1,600-Pt Level

rhboskres

Publish date: Wed, 20 Oct 2021, 04:43 PM

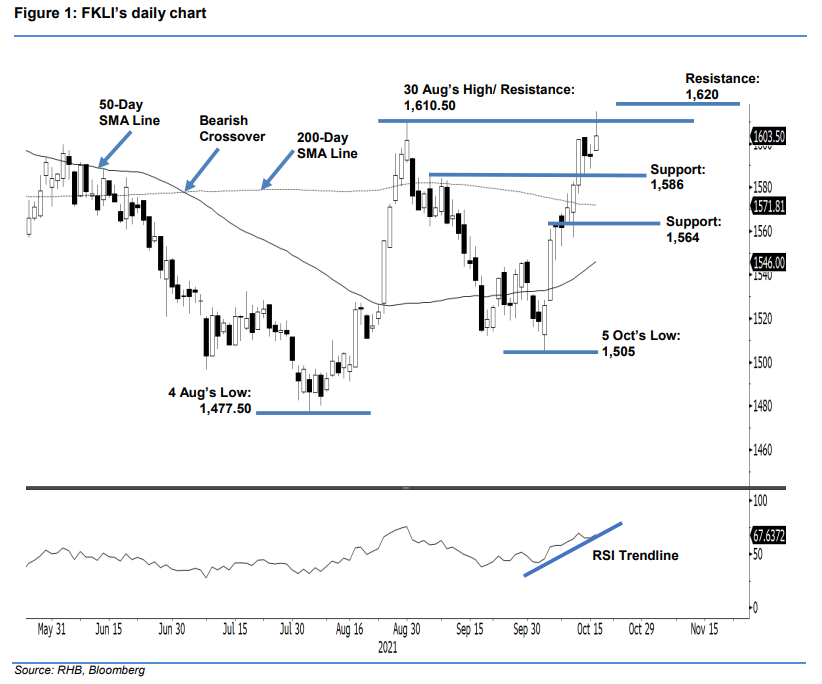

Maintain long positions. The FKLI rose 9.50 pts – tracking its regional peers’ positive sentiment – to close at 1,603.50 pts. On the eve of the holiday, it opened stronger at 1,597 pts and instantly jumped to test the intraday high of 1,614.50 pts. The bears seized control at the day’s high, with selling pressure dragging the index down for the rest of the session, before closing at 1,603.50 pts. Although the index was hovering near the 1,600-pt level, the bulls had a technical advantage at the end of session, as the index managed to establish its footing above the crucial level. As we mentioned in our previous note: As long as the index continues to form a “higher low” bullish pattern, the rally still has legs on the upside. As such, we stay with our positive trading bias.

We recommend traders retain the long positions initiated at 1,556 pts or the closing level of 6 Oct. To mitigate downside risks, the trailing-stop is raised to 1,586 pts.

The immediate support remains at 1,586 pts (the low of 14 Oct), followed by 1,564 pts (11 Oct’s low). On the upside, the nearest resistance is eyed at 1,610.50 pts or the high of 30 Aug, followed by the 1,620-pt round figure.

Source: RHB Securities Research - 20 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024